irs suspends $600 form 1099-k reporting - what you need to know

Published 1 year ago • 1.7K plays • Length 5:51Download video MP4

Download video MP3

Similar videos

-

9:33

9:33

irs delays 1099-k $600 reporting threshold

-

1:36

1:36

irs delays $600 1099-k reporting rule for payment apps

-

25:00

25:00

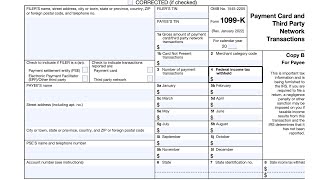

irs form 1099-k walkthrough (payment card & third party network transactions)

-

7:57

7:57

the new 1099-k $600 rule explained | rob.cpa

-

1:01:36

1:01:36

irs webinar: form 1099-k third party payment network transactions

-

4:48

4:48

irs cancels $600 1099-k reporting threshold requirement for 2023

-

![🔴 irs delays $600 1099-k reporting rule [new tax rules in 2024]](https://i.ytimg.com/vi/XEDPCYS_O2o/mqdefault.jpg) 5:49

5:49

🔴 irs delays $600 1099-k reporting rule [new tax rules in 2024]

-

![[breaking news] irs delays $600 1099-k (paypal, venmo) reporting rule](https://i.ytimg.com/vi/j9sN5vw7W9E/mqdefault.jpg) 0:56

0:56

[breaking news] irs delays $600 1099-k (paypal, venmo) reporting rule

-

2:40

2:40

new form 1099 k reporting requirements | 2022 irs updates

-

4:22

4:22

🔴 irs delays $600 threshold for 1099-k reporting | cash app reporting delayed

-

3:09

3:09

new 1099-k update: irs delays $600 reporting for payment platforms

-

6:12

6:12

update to new irs $600 rule 1099-k reporting 2022

-

0:51

0:51

irs postpones implementation of $600 form 1099-k reporting

-

9:34

9:34

🔴 new irs $600 tax rule for venmo, paypal, cash app| form 1099-k 2023 and 2024 latest update

-

0:59

0:59

major tax implication for 2024 ➡️ 1099-k reporting

-

8:29

8:29

irs delays $600 tax rule for venmo, cash app, & paypal | 1099-k update for 2024

-

2:09

2:09

irs update on delay for $600 reporting threshold for third-party payment platforms’ forms 1099-k

-

3:25

3:25

irs delays 1099 $600 reporting threshold

-

5:22

5:22

the irs delayed new $600 reporting for 1099-k

-

0:36

0:36

irs delays $600 1099-k rule 🎉 🥳

-

0:46

0:46

irs delays form 1099-k threshold of $600, prepping for $5,000 in 2024 | jason dinesen | mycpe shorts

-

0:54

0:54

how the irs catches you for tax evasion