4 mistakes uk directors are making when it comes to the hmrc

Published 1 year ago • 193 plays • Length 4:22Download video MP4

Download video MP3

Similar videos

-

4:33

4:33

5 mistakes uk directors are making when they're closing their ltd companies

-

14:31

14:31

warning: the #1 financial mistake uk directors are making (and how to avoid it)

-

2:55

2:55

when can hmrc make me liable for company tax debts?

-

0:59

0:59

👣 3 ways to stop hmrc 👀

-

11:36

11:36

exposing the truth about shopify dropshipping..

-

8:42

8:42

accountant explains: how to pay less tax

-

8:10

8:10

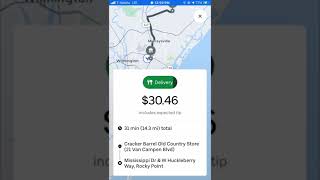

how to deliver uber eats step by step | delivery app tutorial 2023

-

0:38

0:38

why is it taking so long to speak to hmrc

-

10:11

10:11

when to file confirmation of statement and dormant accounts for uk company directors

-

15:37

15:37

how to avoid hmrc self assessment tax investigations - avoid these mistakes!

-

8:45

8:45

directors national insurance - uk | management and financial accounts - i hate numbers

-

4:53

4:53

the wrong share structure in a limited company

-

23:10

23:10

making tax digital - hm revenue and customs & equal experts

-

2:06

2:06

making tax digital uk hmrc legislation explained course

-

10:12

10:12

top 5 vat mistakes (uk)

-

1:48

1:48

the different types of taxes for uk limited companies

-

2:30

2:30

company director advice on hmrc debts

-

0:13

0:13

uber eats accept or decline?

-

0:31

0:31

top 4 ir35 red flags that could trigger an hmrc investigation 🚩

-

11:40

11:40

how to pay yourself as a ltd company uk | best directors salary 2024/2025 (dividends vs salary)

-

0:39

0:39

how hmrc won the war against ir35 non-compliance: a profound investigation

-

0:23

0:23

the tax gap is £32 billion 💵, that should be going to hmrc but doesn’t get collected — gina miller