beps pillar two globe rules - timing differences and re-fundable tax credits

Published 2 years ago • 2.8K plays • Length 18:00Download video MP4

Download video MP3

Similar videos

-

33:42

33:42

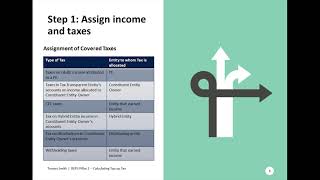

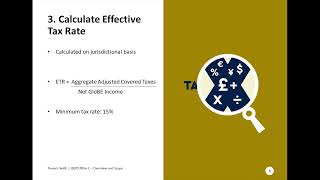

beps pillar two globe rules - calculating top-up tax

-

16:37

16:37

beps pillar two globe rules - overview

-

33:22

33:22

beps pillar two globe rules - charging mechanisms

-

12:24

12:24

beps pillar two globe rules - issues for asset managers

-

6:52

6:52

pillar one and two explained in 7 minutes

-

2:52

2:52

beps 2.0 pillar two: international tax compliance for global companies

-

16:46

16:46

pillar two - the globe-rules

-

8:54

8:54

beps pillar two | global minimum tax

-

13:38

13:38

pwc spotlight podcast series ep. 5: แนวทางรับมือมาตรการทางภาษีอากรระหว่างประเทศ (pillar two)

-

24:10

24:10

s2e10: tbb – do not use money meant to fight inflation in the long term to mitigate inflation now

-

54:36

54:36

pillar two: made simple and practical live webinar

-

![deloitte x taxmann's live webinar | pillar two – global anti-base erosion rules [globe rules]](https://i.ytimg.com/vi/dAwX0_o8viw/mqdefault.jpg) 1:02:23

1:02:23

deloitte x taxmann's live webinar | pillar two – global anti-base erosion rules [globe rules]

-

16:44

16:44

beps pillar 2 is coming: book accounting considerations

-

17:54

17:54

beps pillar 2 and sustainability

-

3:09

3:09

beps 2.0: how to get ready for pillar 2

-

1:33:30

1:33:30

pillar two model rules for domestic implementation of 15% global minimum tax

-

20:11

20:11

pillar two is coming: key issues for u.s. multinationals

-

11:50

11:50

tax. simplified. | introduction to beps

-

1:26:36

1:26:36

oecd's beps pillar 2 are you prepared?

-

0:56

0:56

pillar two