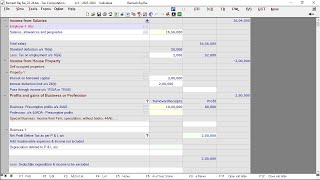

carry forward of loss only when return is filed in time u/s 139(3)

Published 9 years ago • 759 plays • Length 3:07Download video MP4

Download video MP3

Similar videos

-

12:18

12:18

return of income, loss return, belated return, revised return etc

-

5:12

5:12

how to claim last year tds refund or unclaimed tds refund from last 6 year | tds brought forward

-

10:34

10:34

ca final income / direct tax return of loss - section 139(4)

-

1:00

1:00

impact of belated itr on set-off of losses (english)

-

14:21

14:21

how to file itr when you have losses? set off and carry forward of losses | live demo

-

16:03

16:03

section 139(5). revised return for ca classes

-

18:29

18:29

defective return notice u/s 139(9) a.y. 2024-25 | defective itr return | rectify the defect in itr

-

9:26

9:26

sec 139- returns of income

-

6:59

6:59

how to use winman ca-erp?

-

38:10

38:10

practical understanding of set off & carry forward of loss

-

1:17

1:17

when you cannot carry forward the losses? | file your itr ontime | itr filing tips and tricks part-3

-

0:38

0:38

itr filing tips | carry forward of losses | capital gains

-

1:20:08

1:20:08

direct tax laws - return of income section 139(3), (4), (5) & 142(1)

-

0:53

0:53

is there actually any benefit of filing income tax return? #shorts

-

16:15

16:15

set off and carry forward losses theory | section 70 to 80 in income tax | carry forward of losses

-

0:49

0:49

अगर ये किया तो income tax department से notice पक्का आयेगा!

-

1:00

1:00

set off and carry forward of loss in itr ay 2022-23 #shorts #setoffloss #itr

-

11:43

11:43

capital gain itr2 2023-24| set off and carry forward of losses 2023| carry forward loss next year|

-

1:00

1:00

trader का income tax 😭💰!