cfa level i- 2015 -fixed income : calculation of bond price using spot,ytm, forward rate

Published 9 years ago • 28K plays • Length 15:38Download video MP4

Download video MP3

Similar videos

-

6:18

6:18

how to calculate spot rates and forward rates in bonds

-

2:51

2:51

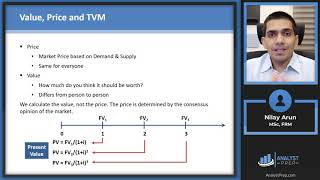

cfa level i fixed income - bond valuation using spot rates

-

21:46

21:46

frm part i-relationship between spot rates, forward rates and ytm

-

2:50

2:50

cfa level i - question bank - calculation of forward rate from spot rates

-

7:15

7:15

cfa level i: fixed income - bond equivalent yield ( bey ) & effective annual yield (eay )

-

8:24

8:24

how to calculate spot rates, forward rates, and discount factors

-

26:26

26:26

cfa/frm bond valuation using par rate

-

21:04

21:04

spot rate vs. forward rates (calculations for cfa® and frm® exams)

-

35:12

35:12

cfa level 1 full course: interest rate risk and return

-

38:53

38:53

cfa level 1 full course: yield and yield spread measures for fixed-rate bonds

-

2:48:30

2:48:30

cfa/frm - key rate duration

-

27:48

27:48

cfa level i- 2015 -fixed income : risk and return part i(of 4)

-

8:59

8:59

valuing a bond using spot rates

-

9:56

9:56

bond price and yield relationship (for the @cfa level 1 exam)

-

4:04

4:04

ytm, bond price with spot rate - cfa level1 practice question

-

7:02

7:02

frm part i- relationship between spot rates and ytm

-

20:31

20:31

cfa l2- fixed income - formula revision video - part i (of ii)

-

32:47

32:47

cfa level i: fixed income - full price(dirty price), flat price(clean price) and accrued interest

-

38:47

38:47

2015- cfa level 2 - fixed income - term structure and interest rate dynamics- part 1 (of 5)

-

9:05

9:05

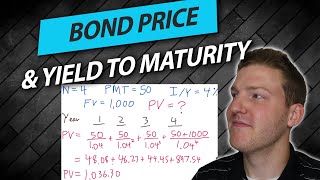

calculate bond price and yield to maturity (ytm) | annual and semi annual bonds

-

14:47

14:47

bond valuation (calculations for cfa® and frm® exams)