deferred tax computation (worked example)

Published 2 years ago • 606 plays • Length 22:00Download video MP4

Download video MP3

Similar videos

-

30:26

30:26

deferred tax (ias 12) | explained with examples

-

5:53

5:53

deferred tax explained

-

11:30

11:30

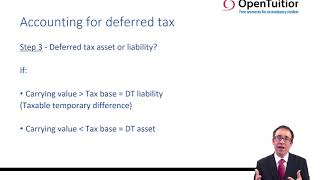

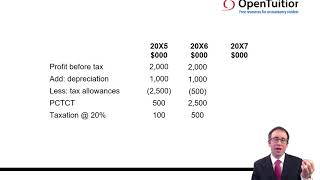

ias 12 - deferred tax accounting - acca financial reporting (fr)

-

10:15

10:15

how to (legally) pay $0 in taxes | why the rich don’t pay taxes?

-

6:07

6:07

how the rich avoid paying taxes

-

5:51

5:51

who pays the lowest taxes in the us?

-

11:36

11:36

deferred tax liability deferred tax liabilities

-

10:54

10:54

ias 12 - deferred tax - acca financial reporting (fr)

-

21:22

21:22

introduction to deferred income taxes

-

58:09

58:09

practice deferred tax assets & liabilities permanent & temporary differences intermediate accounting

-

1:00:04

1:00:04

deferred tax asset & deferred tax liability | intermediate accounting cpa exam far

-

15:28

15:28

deferred tax explained with example | profit & loss approach and balance sheet approach explained

-

7:48

7:48

deferred tax asset & liability: enacted future tax rate

-

12:06

12:06

ias 12 - example (excl. deferred tax) - acca financial reporting (fr)

-

29:38

29:38

ias 12 - income tax (part 1)

-

7:17

7:17

cfa level i fra - tax base, deferred tax assets, deferred tax liabilities

-

20:01

20:01

cima f2 taxation (ias 12) - deferred tax - example