disallowance of payment under section 40a(2) of income tax act

Published 6 years ago • 3.3K plays • Length 2:38Download video MP4

Download video MP3

Similar videos

-

2:12

2:12

preliminary expenses - deduction u/s 35d of income tax act

-

![types of income tax notices and how to respond? [complete list]](https://i.ytimg.com/vi/lfIBVy41vcA/mqdefault.jpg) 3:38

3:38

types of income tax notices and how to respond? [complete list]

-

12:23

12:23

cash payment in excess of 10,000 disallowed. 40a(3) and 40a(3a), rule 6dd ||ca tarique khichi

-

22:15

22:15

section 43b(h) of income tax act & consequences of non/delayed payment to suppliers - msme act

-

15:37

15:37

section 7702 of internal revenue code

-

11:26

11:26

how can i reduce tax on ira withdrawals?

-

19:02

19:02

section 7702 - what do the changes mean?

-

25:01

25:01

reality of international mutual funds | money-minded mandeep | lla

-

5:50

5:50

what income tax returns need to be filed when a person dies?

-

14:13

14:13

payment of gratuity act | statutory compliance | hr tutorials india | what is gratuity? | gratuity

-

9:06

9:06

type a tax free reorganizations (u.s. corporate tax)

-

1:01

1:01

how to amend a tax return with h&r block 2024 | file amended return online free (2024)

-

5:41

5:41

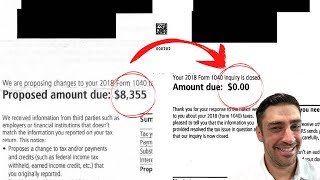

irs proposed amount due – my response #1

-

1:48

1:48

calculation of allocable surplus

-

12:36

12:36

securities act of 1933 exemptions regulation a, d and rule 147. cpa exam

-

0:39

0:39

how to calculate hra tax exemption

-

1:24:12

1:24:12

chartbook super revision english| pgbp in 1.5 hour 🔥 ca inter sep 2024 jan 2025 by ca rajat mogha

-

0:14

0:14

stages of filing taxes with your dad (as illustrated by cats)