does receiving 1099 misc tax form force a contractor to file taxes?

Published 2 years ago • 12 plays • Length 0:23Download video MP4

Download video MP3

Similar videos

-

7:02

7:02

🚨 tax form 1099-misc explained | what is irs form 1099-misc

-

2:58

2:58

how to complete form 1099 misc | independent contractors tax tutorial

-

5:19

5:19

1099 tax deductions explained (2023)

-

1:54

1:54

how to fill out a 1099-misc tax form?

-

11:08

11:08

do you need to issue a 1099? 1099-nec & 1099-misc explained.

-

9:20

9:20

pay less tax | 1099 advantages over w2

-

6:34

6:34

taxes - not knowing this will cost you! | doordash, uber eats, grubhub, spark driver, shipt

-

10:46

10:46

accountant explains why 1099 income is better than w-2 for taxes

-

2:37

2:37

calculating taxes on irs form 1099 misc - turbotax tax tip video

-

6:59

6:59

tax form 1099-misc explained || rent, royalty, prizes income

-

21:08

21:08

irs form 1099-misc line-by-line instructions 2024: how to file a 1099 for contractors 🔶 taxes s2•e75

-

4:15

4:15

how to file the *new* form 1099-nec for independent contractors using turbotax (formerly 1099-misc)

-

21:54

21:54

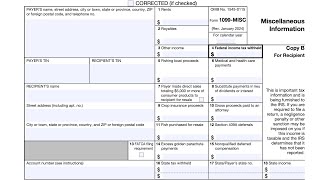

irs form 1099-misc walkthrough (miscellaneous information)

-

0:18

0:18

how much federal income tax will i pay on $100k in 2024?

-

4:01

4:01

do i have to claim 1099 misc income?

-

5:07

5:07

what to do with 1099 misc from california ftb - 2022

-

5:10

5:10

how to file your taxes as an independent contractor? | 1099 forms explained for favor drivers

-

5:46

5:46

should i use a 1099-misc for rental property repairs?

-

![how to file form 1099-nec & form 1099-misc [1099 filing requirements & deadlines] irs' form 1099](https://i.ytimg.com/vi/lYLlh85Pldg/mqdefault.jpg) 45:18

45:18

how to file form 1099-nec & form 1099-misc [1099 filing requirements & deadlines] irs' form 1099

-

2:27

2:27

when do i need to send a 1099 to the independent contractors that i use?

-

1:18

1:18

is 1099-misc same as self-employed?

-

2:18

2:18

10 things you should know about 1099s