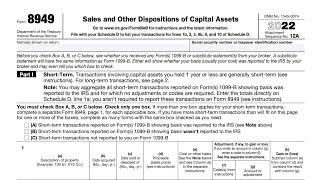

form 8949 & generally, what is the disposition of assets

Published 4 years ago • 1.5K plays • Length 10:43Download video MP4

Download video MP3

Similar videos

-

22:25

22:25

irs form 8949 walkthrough (sales and other dispositions of capital assets)

-

5:22

5:22

reporting capital gains on irs form 8949 and schedule d

-

6:09

6:09

how to fill out irs form 8949

-

4:21

4:21

zenledger crypto tax software makes defi crypto taxes easy (form 8949)

-

1:12:55

1:12:55

tradelog class: reconciling 1099-b and ending the tax year, form 8949

-

3:04

3:04

how to use irs form 8949 for reporting capital gains and losses?

-

11:19

11:19

form 1099-s on form 1040 for 2022 - principal residence exclusion

-

8:46

8:46

can you deduct investment fees on your taxes?

-

16:55

16:55

how to fill out irs form 941 - simple example for s corporation

-

19:09

19:09

disposition of personal use property, listed personal property, and foreign exchange.

-

13:48

13:48

irs form 945-x walkthrough (adjusted return of withheld federal income tax or claim for refund)

-

2:35

2:35

when to use irs form 8949 for stock sales - turbotax tax tip video

-

7:26

7:26

how to report form 1099-s on form 1040 for sale of real estate

-

11:56

11:56

form 8949 sales and other dispositions of capital assets #form8949

-

4:47

4:47

how to report crypto on form 8949 for taxes | coinledger

-

2:11

2:11

how to easily report capital gains on form 8949 using the form8949.com app

-

10:09

10:09

irs form 4952 - investment interest expense deduction

-

6:22

6:22

irs form 8949 reporting for qualified opportunity zones with form 8997

-

20:03

20:03

2018 tax forms reporting property dispositions

-

1:36

1:36

one step 2022 form 8949

-

14:09

14:09

how do i report debt forgiven on my residence?

-

2:52

2:52

reporting capital gains and losses on schedule d and form 8949