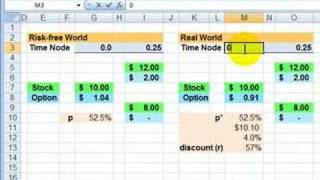

frm: black-scholes versus binomial

Published 16 years ago • 88K plays • Length 5:47Download video MP4

Download video MP3

Similar videos

-

5:59

5:59

frm: intuition behind the black-scholes-merton

-

11:53

11:53

black scholes merton option pricing model (frm t4-11)

-

6:53

6:53

frm: binomial (one step) for option price

-

14:12

14:12

how to interpret n(d1) and n(d2) in black scholes merton (frm t4-12)

-

10:00

10:00

frm: how d2 in black-scholes becomes pd in merton model

-

31:22

31:22

the trillion dollar equation

-

16:12

16:12

quant finance 1 - why we never use the black scholes equation, 1

-

1:20:29

1:20:29

20. option price and probability duality

-

9:20

9:20

frm: basis risk is the mother of all derivatives risk

-

5:37

5:37

what are the deficiencies of the black-scholes model? why is the bs model still used?

-

12:40

12:40

market maker's delta-hedge illustrated (frm t4-20)

-

15:54

15:54

warren buffett: black-scholes formula is total nonsense

-

10:24

10:24

introduction to the black-scholes formula | finance & capital markets | khan academy

-

6:18

6:18

frm: why we use log returns in finance

-

8:57

8:57

frm: two step binomial

-

9:23

9:23

black scholes option pricing model explained in excel

-

18:10

18:10

option delta (frm t4-13)

-

21:49

21:49

lognormal property of stock prices assumed by black-scholes (frm t4-10)

-

9:12

9:12

frm: risk neutral valuation in option pricing model