get - tax matters and 1099-q faqs

Published 11 years ago • 4.4K plays • Length 7:45Download video MP4

Download video MP3

Similar videos

-

5:40

5:40

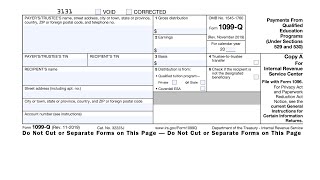

irs form 1099-q distributions from section 529 plans

-

4:01

4:01

tax form 1099-q explained || 529 plan withdrawal

-

3:36

3:36

irs form 1099-q explained: payments from qualified education savings programs

-

1:56

1:56

do i have to report a 1099-q on my taxes? - countyoffice.org

-

2:15

2:15

do i have to report 1099-q on my taxes? - countyoffice.org

-

1:58

1:58

do you have to report a 1099-q on your tax return? - countyoffice.org

-

7:00

7:00

1099 tax benefits explained

-

2:14

2:14

do i have to report 1099-q on my tax return? - countyoffice.org

-

6:36

6:36

529 college savings plan explained

-

6:00

6:00

maximize deductions for 1099 contractors

-

2:42

2:42

beware: some 1099 tax forms can trick you

-

3:05

3:05

who pays taxes on 529 withdrawals?

-

3:12

3:12

what is form 1099-q: payments from qualified education programs?

-

5:52

5:52

how to enter 1099-q into turbotax

-

2:03

2:03

when do i need to issue a 1099?

-

1:26

1:26

how to print and file form 1099 q

-

15:37

15:37

irs form 1099-q walkthrough (payments from qualified education programs (under sections 529 and 530)

-

1:13

1:13

how to print 1099 q with ez1099 software

-

6:49

6:49

what is form 1099-g and how does it impact my taxes?!

-

3:37

3:37

what is the 1099-b tax form

-

1:53

1:53

how to add a form with 1099 pro tax software