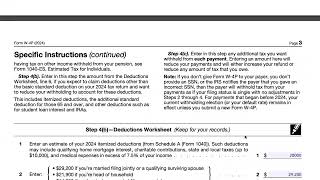

how do i complete irs form w-4p if i retired earlier this year?

Published 2 months ago • 542 plays • Length 17:32Download video MP4

Download video MP3

Similar videos

-

17:27

17:27

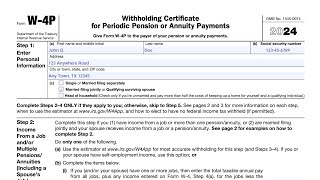

irs form w-4p walkthrough (withholding certificate for periodic pension or annuity payments)

-

14:32

14:32

how to adjust your form w-4p with pension income & social security benefits

-

5:49

5:49

understanding the new irs form w-4p

-

21:34

21:34

what happens to your irs form w-4p after you've submitted it?

-

14:50

14:50

how to fill out irs form w-4p

-

18:03

18:03

how to fill out irs form w4-p (2024)

-

11:00

11:00

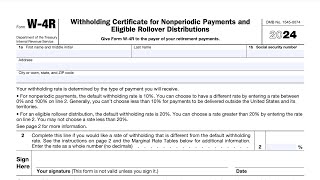

irs form w-4r walkthrough (withholding certificate for nonperiodic payments and eligible rollovers)

-

5:35

5:35

should i convert my retirement to roth?

-

1:33:41

1:33:41

how the same portfolio can be riskier for me than for you | live q&a

-

4:11:31

4:11:31

accounting for slow learners

-

2:37

2:37

how do i get an ss4 form from the irs? - countyoffice.org

-

0:47

0:47

what rich people know about 401k’s that you don’t 🚨

-

0:41

0:41

how to avoid paying taxes...legally

-

10:54

10:54

retirement tax withholding

-

20:13

20:13

how to use the irs tax withholding estimator tool (a walkthrough)

-

0:59

0:59

should you consider changing your tax withholding through the end of the year? 🤔

-

3:11

3:11

w4 form 2024 quick overview | filling out the w-4 tax form | money instructor

-

3:44

3:44

how to fill out an irs w-4 form | money instructor

-

6:23

6:23

can i get a bigger tax refund if i don't claim dependents on irs form w4?

-

11:43

11:43

irs form w-4s walkthrough (request for federal income tax withholding from sick pay)

-

1:00

1:00

who qualifies to claim exempt???

-

0:59

0:59

how much can i contribute to my 401k in 2023?