how do taxes work? forms w2 and 1099 explained

Published 2 months ago • 24 plays • Length 17:59Download video MP4

Download video MP3

Similar videos

-

35:26

35:26

how do taxes work? — simple 1099 walkthrough

-

28:09

28:09

how do taxes work? — simple w2 walkthrough

-

4:46

4:46

w-2 and 1099 forms explained

-

5:19

5:19

1099 tax deductions explained (2023)

-

3:27

3:27

w-2 and 1099: how do you file taxes when you have both?

-

9:22

9:22

w2, w4, w9, 1099 tax forms: what's the difference? (and which one do you need?)

-

4:00

4:00

get an llc to avoid paying high taxes?

-

11:08

11:08

do you need to issue a 1099? 1099-nec & 1099-misc explained.

-

10:12

10:12

employee vs independent contractor tax differences | w-2 vs 1099

-

4:24

4:24

how to read your w-2 tax form | money instructor

-

4:48

4:48

understanding the w-2 and 1099 form

-

7:00

7:00

1099 tax benefits explained

-

27:12

27:12

how to file taxes with w-2 and 1099 together in 2024: guide for multi-income workers 🔶 taxes s3•e113

-

18:28

18:28

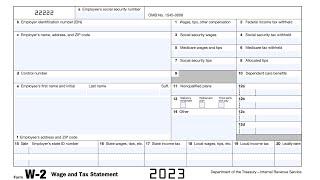

irs form w-2 walkthrough (wage and tax statement)

-

5:28

5:28

understanding tax season: form w-2

-

2:09

2:09

benefits of filing 1099 & w-2 forms - expresstaxfilings

-

3:49

3:49

tax forms, documents needed to file your irs 1040 tax return. w-2, 1099, ssa, schedule c, 1098, div

-

11:27

11:27

2022 taxes: understanding the tax forms you need to file

-

15:01

15:01

1099 vs w2: how should you pay your employees?

-

0:41

0:41

how to avoid paying taxes...legally

-

0:43

0:43

what is my max 401k contribution with a w2 and 1099 income?