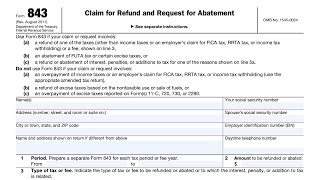

how to abate irs penalties, former irs agent explains, use form 843, go to my website, 777irs.com

Published 1 year ago • 1K plays • Length 5:12Download video MP4

Download video MP3

Similar videos

-

6:48

6:48

remove irs tax penalties step by step guide irs form 843, irs penalty abatement form

-

6:10

6:10

former irs agents reveals how to write a irs penalty abatement letter 2 the irs & what to include

-

12:12

12:12

how to get irs penalties removed? - fill out form 843 irs request for penalty & interest abatement

-

19:27

19:27

irs form 843 walkthrough (claim for refund & request for abatement)

-

17:33

17:33

form 843 - request for penalty abatement

-

3:44

3:44

how to fill out an irs w-4 form | money instructor

-

2:23

2:23

what is form 843: claim for refund and request for abatement?

-

10:22

10:22

how to get your irs tax penalties waived in 3 easy steps

-

10:44

10:44

how to avoid income tax notice | cash deposit limit in bank to avoid income tax notice in tamil

-

4:10

4:10

🎥 unlock the secrets of irs form ss-4! 📑💼 verification of tax id# or ein#

-

2:15

2:15

how to complete form 433-b (oic) section 7 signatures, dates, final, checklist

-

10:00

10:00

how to file form 843 for irs penalty abatement

-

7:54

7:54

how to get the irs to forgive your penalties and interest - tax hack

-

9:06

9:06

irs penalty abatement - how you can get money back!

-

0:54

0:54

how the irs catches you for tax evasion

-

9:23

9:23

first-time irs penalty abatement: your ultimate guide to saving money 💰 | rob cpa

-

12:31

12:31

irs penalty relief - reasonable cause tax penalty abatement explained

-

2:58

2:58

how to get help from the taxpayer advocate service | irs form 911

-

7:36

7:36

irs form 843 - request a refund of fica taxes

-

8:41

8:41

how to apply for abatement of horrendous penalty & interest ep.2017-08

-

![first time penalty abatement of the irs tax penalty for late filing [irs tax penalties]](https://i.ytimg.com/vi/UQcGSPqWgKM/mqdefault.jpg) 13:19

13:19

first time penalty abatement of the irs tax penalty for late filing [irs tax penalties]

-

5:47

5:47

how to stop irs, bank levies, wage garnishments, tax liens, former irs agent explains