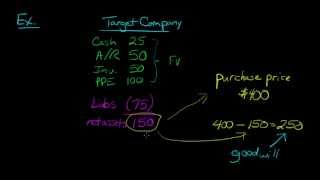

how to calculate goodwill in m&a deals and merger models [tutorial]

Published 5 years ago • 30K plays • Length 17:34Download video MP4

Download video MP3

Similar videos

-

21:50

21:50

earnout modeling in m&a deals and merger models

-

13:25

13:25

accretion dilution - rules of thumb for merger models

-

16:10

16:10

negative goodwill and bargain purchases in merger models

-

20:32

20:32

expense synergies in merger models

-

23:32

23:32

private company valuation

-

19:59

19:59

merger model: cash, debt, and stock mix

-

5:13

5:13

warren buffett on how to think about goodwill

-

44:08

44:08

nav calculations of mutual and hedge fund process | fund unit creation |interview q & a on nav calc

-

7:43

7:43

calculating your money-weighted rate of return (mwrr)

-

6:10

6:10

goodwill in accounting, defined and explained

-

10:56

10:56

how to calculate goodwill for amazon's acquisition of ring

-

23:00

23:00

purchase accounting for noncontrolling interests aka minority interests

-

20:06

20:06

exchange ratios in m&a deals: fixed, floating, and collars

-

12:18

12:18

pro-forma earnings vs. gaap in merger models

-

5:58

5:58

purchase price allocation: goodwill

-

16:33

16:33

goodwill (for the @cfa level 1 exam)

-

14:01

14:01

enterprise value vs. purchase price: the “true” price in an m&a deal