how to calculate mortgage interest deduction over 750,000? - countyoffice.org

Published 3 months ago • 30 plays • Length 2:01Download video MP4

Download video MP3

Similar videos

-

1:14

1:14

where is mortgage interest on a tax return? - countyoffice.org

-

1:29

1:29

what percentage of mortgage interest is tax-deductible? - countyoffice.org

-

1:49

1:49

how much tax return on mortgage interest? - countyoffice.org

-

1:47

1:47

how to show property tax and mortgage in income tax? - countyoffice.org

-

9:50

9:50

mortgage interest tax deduction

-

1:36

1:36

is a 1098 mortgage interest tax-deductible? - countyoffice.org

-

1:44

1:44

is a second mortgage tax-deductible? - countyoffice.org

-

5:10

5:10

how to calculate your mortgage payment

-

7:47

7:47

mortgage calculator: a simple tutorial (template included)!

-

24:39

24:39

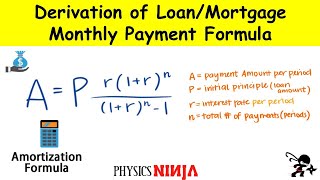

derivation of loan/mortgage monthly payment formula

-

6:14

6:14

how to calculate mortgage interest tax credit

-

3:49

3:49

how principal & interest are applied in loan payments | explained with example

-

0:21

0:21

how to claim the mortgage interest deduction on your taxes

-

0:21

0:21

how to claim the mortgage interest deduction on your taxes

-

0:57

0:57

how to find simple interest using formula / simple interest /#shorts / how to find simple interest

-

0:35

0:35

💰how to deduct your home expenses to save on taxes #tax #realestatetips #officededuction

-

1:50

1:50

mortgage interest deduction

-

11:59

11:59

how to calculate your monthly mortgage payment given the principal, interest rate, & loan period

-

2:44

2:44

mortgage interest deduction... what is that?!?

-

0:54

0:54

how the irs catches you for tax evasion

-

3:20

3:20

mortgage interest deduction calculator - how much mortgage interest is deductible?

-

17:26

17:26

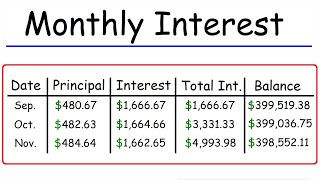

how to calculate the monthly interest and principal on a mortgage loan payment