how to claim deduction u/s 80tta in itr-1 for ay 2022-23 ii show 80 tta in itr-1 ii #cavedtaya

Published 2 years ago • 10K plays • Length 9:53Download video MP4

Download video MP3

Similar videos

-

5:59

5:59

how to claim deduction u/s 80tta in itr for ay 2023-24 ii show 80 tta in itr ii #cavedtaya

-

6:46

6:46

how to claim deduction u/s 80ttb in itr-1 for ay 2024-25 ii show 80 ttb in itr-1 ii

-

8:05

8:05

how to claim deduction u/s 80tta in itr for ay 2024-25 ii show 80 tta in itr ii

-

8:29

8:29

how to claim deduction u/s 80ttb in itr-1 for ay 2023-24 ii show 80 ttb in itr-1 ii #cavedtaya

-

4:55

4:55

80tta and 80ttb deduction | tax on fd interest in india | tax on interest from saving bank account

-

15:08

15:08

section 80tta v/s 80ttb for fy 2019-20 | tax on saving account interest and fixed deposit interest

-

9:03

9:03

tax benefit on disability 80u & 80dd u/s | how disability deduction claim in itr ay. 2024-25 | itr

-

7:21

7:21

what is section 80g? | tax deductions on your donations | deduction u/s 80g | tax saving tips

-

6:20

6:20

how to claim deduction 80tta & 80ttb in itr-2 for ay 2023-24 ii #cavedtaya

-

7:57

7:57

how to add deduction in itr filing | how to fill deduction in itr | how to claim deduction in itr

-

9:28

9:28

80ttb in itr2 a.y 22-23 | 80ttb deduction in itr2 a.y 22-23| how to claim 80ttb in itr2|

-

1:00

1:00

claimed 80tta in itr? | tax benefits | vakilsearch #shorts #ytshorts

-

4:14

4:14

how to deduct interest from saving bank account in income tax e filing - 80tta it section

-

10:35

10:35

how to claim deductions under 80c to 80u in itr1 | etwealth

-

2:45

2:45

live - fill section 80eea & 80ee in income tax return | claim deduction u/s 80eea & 80ee ay 2022-23

-

1:00

1:00

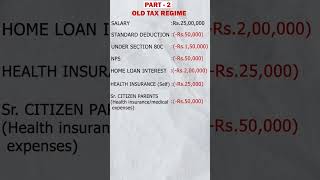

old tax vs new tax regime (fy 2023-24):which one would you choose? let's understand with an example

-

9:47

9:47

80tta deduction under income tax i 80tta deduction for ay 2021-22

-

2:29

2:29

80tta deduction under income tax ay 2023-24 | section 80tta deduction from saving account interest

-

1:00

1:00

have you submitted your 80d in itr? | vakilsearch #ytshorts #shorts #trending