how to find the historical volatility (standard deviation) of an asset

Published 11 years ago • 75K plays • Length 7:39Download video MP4

Download video MP3

Similar videos

-

5:11

5:11

10. how to price options based on implied and historical volatility

-

5:25

5:25

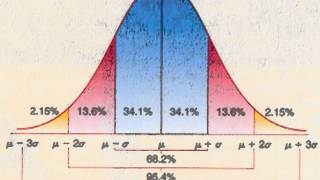

understanding standard deviation in trading, part 2: the math

-

4:11

4:11

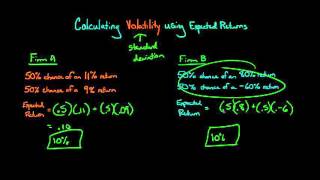

how to calculate volatility using historical returns

-

5:36

5:36

volatility calculation - the best way to understand historical volatility

-

3:55

3:55

chart scan trading lesson: implied volatility vs historical volatility

-

17:06

17:06

calculating the volatility using the standard deviation of returns for a tradeable asset

-

7:11

7:11

frm: how to calculate (simple) historical volatlity

-

4:28

4:28

understanding standard deviation in trading

-

39:25

39:25

calculating options greeks that matter: delta, gamma, theta - raj malhotra

-

12:56

12:56

how to find the best time to trade: implied volatility, explained | options for beginners

-

16:21

16:21

how to calculate the intrinsic value of a stock like benjamin graham! (step by step)

-

19:22

19:22

implied volatility vs. historical volatility

-

1:06

1:06

difference between historical volatility and implied volatility

-

![what is historical volatility? [episode 440]](https://i.ytimg.com/vi/j_BraRBLEf8/mqdefault.jpg) 3:06

3:06

what is historical volatility? [episode 440]

-

16:48

16:48

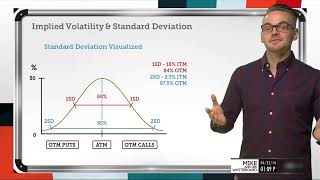

implied volatility & standard deviation explained

-

3:02

3:02

vscap: how to calculate the volatility of a stock

-

5:54

5:54

how to calculate volatility using expected returns

-

1:29:04

1:29:04

fdrm fall-2019 / # 18 / calculation of historical volatility -options / dated 5-nov-'19

-

6:31

6:31

what is the periodic daily return of an asset?

-

40:07

40:07

how to calculate realized & implied volatility and why it's important - christopher quill

-

0:48

0:48

what is historical volatility and implied volatility

-

3:18

3:18

historical volatility versus implied volatility