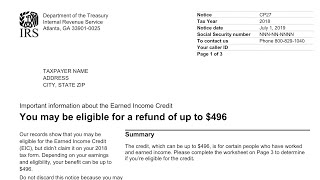

how to understand your cp09 notice (irs tax credit - earned income credit)

Published 6 months ago • 3.1K plays • Length 11:03Download video MP4

Download video MP3

Similar videos

-

11:27

11:27

how to understand your cp27 notice (irs tax credit - earned income credit)

-

4:57

4:57

irs cp09 notice - earned income tax credits

-

18:46

18:46

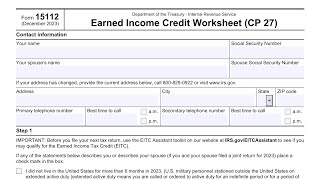

irs form 15111 walkthrough (earned income credit worksheet/cp 09)

-

15:39

15:39

how to use the irs earned income tax credit (eitc) assistant

-

5:22

5:22

earned income tax credit (eitc) explained

-

9:22

9:22

how to understand your cp25 notice (irs adjusted your tax return. you have a zero balance.)

-

10:52

10:52

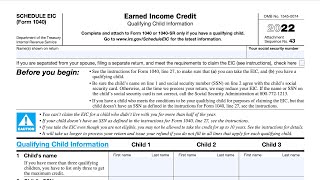

schedule eic walkthrough (earned income credit)

-

3:51

3:51

what should you do if you have received a notice from ird? | simplebooks tax

-

29:27

29:27

understanding the nar commission lawsuit | ep. 382

-

5:49

5:49

ease of paying taxes act (eopt) explained for percentage tax (micro and small taxpayers)

-

15:08

15:08

how to understand your cp21e notice (irs made the changes to your tax return because of an audit).

-

6:31

6:31

how to understand your cp63 notice (irs is holding your refund until you file a prior year return)

-

14:51

14:51

how to understand your cp77 notice (irs intends to levy and seize assets to pay your tax bill)

-

8:52

8:52

earned income tax credit (eitc) explained

-

0:12

0:12

what is the earned income tax credit (eitc)?

-

8:37

8:37

earned income tax credit for 2024. step-by-step guide

-

1:28

1:28

how to complete form 433-a (oic) - section 9 other information - yes/no questions

-

11:29

11:29

how to understand your cp24e notice (irs adjusted your tax return. you'll receive a refund.)

-

6:48

6:48

earned income tax credit: how to fill out your tax return to claim the credit

-

14:12

14:12

irs form 15112 walkthrough (earned income credit - cp27)

-

12:25

12:25

how to understand your cp22i notice (irs made adjustments to irs form 5329, you owe taxes)