how to understand your cp60 notice (the irs misapplied a tax payment to your account)

Published 1 month ago • 88 plays • Length 9:47Download video MP4

Download video MP3

Similar videos

-

12:25

12:25

how to understand your cp22i notice (irs made adjustments to irs form 5329, you owe taxes)

-

9:22

9:22

how to understand your cp25 notice (irs adjusted your tax return. you have a zero balance.)

-

11:29

11:29

how to understand your cp24e notice (irs adjusted your tax return. you'll receive a refund.)

-

15:08

15:08

how to understand your cp21e notice (irs made the changes to your tax return because of an audit).

-

13:09

13:09

how to understand your cp12e notice (irs found an error on your tax return. you're getting a refund)

-

8:11

8:11

how to understand your cp05 notice (holding your tax refund for further review)

-

![cp504 irs notice of intent to levy [what is it? what to do?]](https://i.ytimg.com/vi/yGEzVAB8xAs/mqdefault.jpg) 6:20

6:20

cp504 irs notice of intent to levy [what is it? what to do?]

-

13:29

13:29

美国国税局 (irs) 如何选择审计目标? 【北美华人】个人税和公司税被审计的几率有多少?如何降低审计风险,防止审计?

-

8:12

8:12

what is an irp5 tax certificate? (bonus point at the end)

-

8:40

8:40

什么是ctos?

-

1:56

1:56

what is a short term irs payment plan? - creditguide360.com

-

0:54

0:54

how the irs catches you for tax evasion

-

2:39

2:39

irs letter cp3219a: statutory notice of deficiency

-

1:05

1:05

cp14 notice? here to help.

-

5:38

5:38

what is the irs cp80 tax notice?

-

8:48

8:48

how to understand your cp06 notice (irs needs additional documentation for the aptc)

-

3:58

3:58

irs cp10 tax notice - the irs adjusted your tax refund

-

5:41

5:41

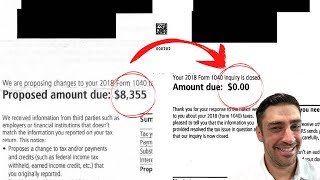

irs proposed amount due – my response #1

-

4:01

4:01

puerto rico tax benefits explained: act 60 & more | ask a cpa

-

0:09

0:09

top 6 ways to solve irs tax problems

-

![irs cp2000 notice [best guide] understand your cp2000 notice & how to respond to the irs](https://i.ytimg.com/vi/C_GNqYT-JsA/mqdefault.jpg) 8:40

8:40

irs cp2000 notice [best guide] understand your cp2000 notice & how to respond to the irs