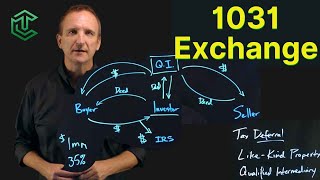

how you can eliminate capital gains taxes with 1031 exchanges | the ihara team | hawaii real estate

Published 5 months ago • 97 plays • Length 1:47Download video MP4

Download video MP3

Similar videos

-

10:29

10:29

deferring capital gains taxes in real estate with a 1031 exchange - everything you need to know

-

0:41

0:41

understanding the benefits of a 1031 exchange for real estate investment

-

55:58

55:58

toby rodes - unlocking value in japan (ep.407)

-

7:53

7:53

how to fund a living trust | avoid probate the correct way

-

21:32

21:32

vocabulary terms from the real estate exam | prepagent

-

3:52

3:52

1031 exchanges | real estate exam prep concepts

-

23:54

23:54

1031 exchange explained: a real estate strategy for investors

-

0:39

0:39

the secrets of the 1031 exchange:

-

0:59

0:59

1031 for real estate investors | zero capital gain tax

-

0:32

0:32

1031 exchanges: understanding the 4 types

-

12:32

12:32

1031 exchange explained

-

1:33:25

1:33:25

everything you wanted to know about 1031 exchanges

-

9:36

9:36

how to sell rentals tax free as a real estate investor | 1031 exchange method explained

-

5:09

5:09

what is a 1031 exchange & should you use one?

-

9:21

9:21

section 1031 exchange basics: how to avoid capital gains tax

-

1:27

1:27

delaware statutory trust 1031: the basics (in under 2 minutes)

-

10:31

10:31

1031 exchange | what you need to know

-

20:10

20:10

how to use a 1031 exchange to avoid taxes in real estate investing

-

12:29

12:29

1031 exchange explained: how to pay zero tax on real estate gains