implied volatility skew & three things it can tell you

Published 7 years ago • 69K plays • Length 16:40Download video MP4

Download video MP3

Similar videos

-

10:43

10:43

volatility skew explained | options trading concepts

-

23:35

23:35

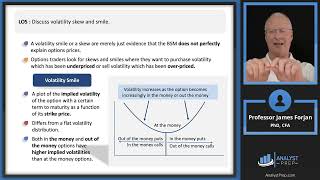

options strategies – part iii: volatility skew and smile, and strategies (2024 level iii cfa® – r7)

-

35:08

35:08

implied volatility, volatility skew, and the term structure of volatility

-

6:54

6:54

know the implied volatility skew in options trading in the 9th learning module of 5paisa

-

3:51

3:51

how to find implied volatility skew for a stock & option expiration

-

40:08

40:08

what is implied volatility & why it's important - options pricing - options mechanics

-

7:48

7:48

how to beat market makers || volatility smile and put-call parity explained

-

12:56

12:56

how to find the best time to trade: implied volatility, explained | options for beginners

-

1:16:30

1:16:30

option volatility skew

-

31:22

31:22

marketchameleon.com pre market show we look at implied volatility skew

-

58:54

58:54

⏰ synergy traders #54: how to combine 3 market indicators with peter schultz

-

1:24

1:24

three ways to tell volatility skews

-

16:17

16:17

|| what is volatility skew ? || how it is calculated ? || (part #3) -english version ||

-

0:19

0:19

unlocking the power of implied volatility in stock market success

-

0:53

0:53

why implied volatility is key to your trading strategy

-

3:23

3:23

implied volatility: volatility skew || how to use quantsapp? || #options analytics tool

-

5:37

5:37

how to use implied volatility skew to trade a credit put spread

-

9:08

9:08

volatility skew – is it a cue to option trading? #nifty #futuresandoptions

-

0:59

0:59

option greeks explained in 1 minute ⏱🧠

-

0:23

0:23

should you be trading options? 🤔

-

1:01

1:01

call option skew- tesla example

-

0:44

0:44

skew volatility - learning from the past #optionstrading #volatility #stockmarket