computation of income from let-out house property.

Published 2 years ago • 34K plays • Length 7:44Download video MP4

Download video MP3

Similar videos

-

15:03

15:03

deduction from house property section 24 i interest on home loan deduction u/s 24(b)

-

1:26

1:26

tax benefits on under-construction property.

-

3:41

3:41

bank pensioners - important

-

6:04

6:04

claiming pre-construction period interest in income tax

-

19:53

19:53

home loan tax benefit a.y 2024-25 | एक ग़लती से home loan पर tax benefit नहीं मिलेगा a.y 24-25

-

1:00

1:00

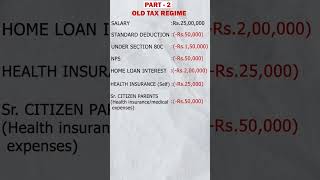

old tax vs new tax regime (fy 2023-24):which one would you choose? let's understand with an example

-

7:24

7:24

how to claim tax benefits on home loans | sec 80c & 24b | navi | hindi

-

9:40

9:40

home loan tax benefit 2023-24 | tax benefit on home loan | joint home loan tax benefit

-

1:01

1:01

tax benefits on home loan. #shorts

-

5:48

5:48

section 24b: up to ₹2 lakh tax benefits on home loans | max limit, pre-construction interest | navi

-

0:47

0:47

home loan tax benefits reversal - moneymaker

-

6:00

6:00

deduction of interest on housing loan u/s 24(b) allowable if interest is paid by spouse of assessee?

-

13:27

13:27

home loan के सारे tax benefits समझिये

-

0:53

0:53

section 24b to save tax #shorts #incometax #taxsaving

-

10:40

10:40

interest on home loan deduction | section 24(b) | tax benefits of home loan | ca manoj gupta |

-

0:52

0:52

home loan tax benefits (2022)!

-

0:52

0:52

choose between old tax regime and new tax regime (fy 2023-24)

-

0:35

0:35

home loan benefits i income tax i section 80c i interest element

-

0:17

0:17

home loan aid tax planning

-

1:00

1:00

taxation benefits from your housing loan.

-

1:00

1:00

home loan tax benefit 2022-23

-

0:43

0:43

home loan paid in advance,deduction allowed??|| #viral #shorts #viralshorts #ytshorts #trending ||