irs form 8801 (credit for prior year amt) - step-by-step guide and example

Published 9 months ago • 870 plays • Length 13:20Download video MP4

Download video MP3

Similar videos

-

37:06

37:06

irs form 8801 walkthrough (credit for prior year minimum tax-individuals, estates, and trusts)

-

14:12

14:12

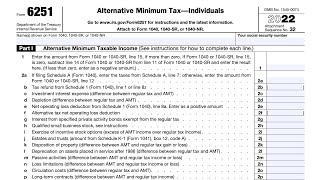

irs form 6251 alternative minimum tax (amt) for incentive stock options (iso)

-

12:54

12:54

work opportunity tax credits - irs form 8850 & dol form 9061

-

3:57

3:57

irs letter 6419 and the child tax credit (form 8812)

-

58:05

58:05

understanding form 990

-

9:49

9:49

review jujur wise card (2024)

-

8:55

8:55

【钱钱不见了】时事特辑!月薪rm1,700究竟能不能买honda hr-v?

-

8:21

8:21

tax credit on vehicle home ev chargers - irs form 8911

-

38:16

38:16

irs form 6251 walkthrough (alternative minimum tax for individuals)

-

5:32

5:32

irs form 8962 premium tax credit and the irs form 1095-a

-

12:54

12:54

irs form 1040-x | how to file amended form 1040 - child tax credit (ctc) on form 8812

-

9:42

9:42

how to complete irs form 1128 for a change in tax year

-

1:03

1:03

irs form 8809 - order summary

-

10:00

10:00

irs form 1040 schedule 3 - intro to the different fields

-

0:35

0:35

the irs has finalized form 1095 b & c for 2022

-

25:25

25:25

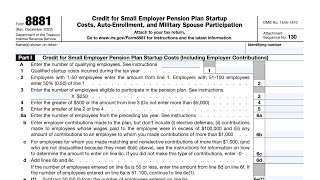

irs form 8881 walkthrough (small business employer pension plan credits for 2023 and later)

-

21:24

21:24

irs form 8697 walkthrough (interest computation under the look-back method for completed contracts)

-

7:11

7:11

3 reasons to opt out of monthly child tax credit payments

-

27:26

27:26

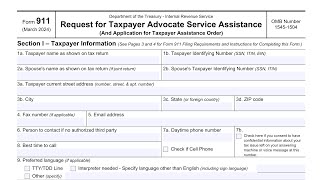

irs form 911 walkthrough (request for taxpayer assistance)

-

12:46

12:46

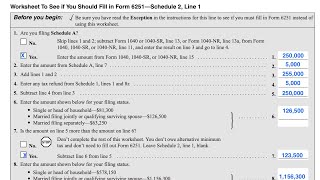

do you need to complete irs form 6251 to calculate amt (alternative minimum tax)?

-

1:24

1:24

what is form 990-t?