irs section 179 deduction explained

Published 2 years ago • 13K plays • Length 1:56Download video MP4

Download video MP3

Similar videos

-

2:23

2:23

irs section 179 deduction explained

-

22:02

22:02

section 179 deduction. explained with examples. cpa/ea exam

-

7:51

7:51

irs section 179 deduction explained - commercial capital company

-

2:17

2:17

irs section 179 deduction 2017 tax year

-

7:23

7:23

depreciation 101: is the section 179 deduction right for your business?

-

16:52

16:52

ikrm: isu gaji jejaskan kesejahteraan rakyat?

-

12:13

12:13

how anwar ibrahim is fixing malaysia's debt problem

-

![jangan bagi banker ubah hidup you [hutang] asbf, loan kenderaan](https://i.ytimg.com/vi/IFjuTl6zI_I/mqdefault.jpg) 9:49

9:49

jangan bagi banker ubah hidup you [hutang] asbf, loan kenderaan

-

2:23

2:23

irs section 179 deduction 2017 explained

-

3:37

3:37

how to use irs section 179 to benefit your business

-

1:05

1:05

section 179 deduction

-

10:58

10:58

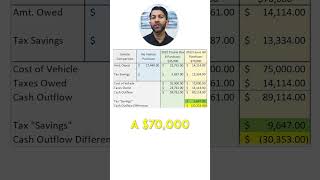

disadvantages of writing off your car in 2024 - section 179

-

12:21

12:21

what is the section 179 deduction and how does it work? - part 1 of 2

-

11:26

11:26

section 179 deduction 2022

-

21:58

21:58

section 179 deduction cost recovery. cpa exam

-

3:50

3:50

section 179 depreciation update | mark j kohler | tax & legal tip

-

10:57

10:57

irs form 4562 (depreciation & amortization) - claim section 179 expense | step-by-step guide

-

1:00

1:00

debunking myths: writing off your vehicle

-

3:25

3:25

irs section 179 deduction - irs section 179 deduction benefits, section 179 deduction, rowe ford

-

29:25

29:25

the section 179 deduction and bonus depreciation: understand the differences

-

13:07

13:07

bonus depreciation vs section 179 - which is right for your business?

-

7:32

7:32

instantly deduct business expenses with section 179 – here's how