is my startup eligible for the r&d tax credit payroll offset?

Published 5 years ago • 157 plays • Length 0:54Download video MP4

Download video MP3

Similar videos

-

1:51

1:51

how do i claim the r&d tax credit payroll offset?

-

3:25

3:25

what is the benefit of an r&d tax credit for startups?

-

1:12

1:12

what is an r&d tax credit and what does it mean for startups?

-

6:03

6:03

payroll provider’s involvement with r&d tax credit

-

1:02

1:02

startup taxes: what qualifies as r&d expense?

-

0:53

0:53

payroll tax credit offset r&d tax credit

-

4:00

4:00

if your startup is acquired, can you still use the r&d tax credit?

-

7:22

7:22

the imf is worried about a low growth future when that’s exactly what we need

-

7:32

7:32

power of communication | how to communicate effectively | career talk with anand vaishampayan

-

22:44

22:44

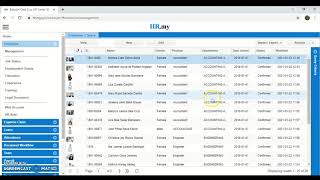

what is hr.my and how it will be use?

-

5:08

5:08

do you know how to max out your r&d tax credit?

-

3:42

3:42

if you've filed your taxes & your accountant didn’t do an r&d credit for you, can you still get it?

-

3:09

3:09

why are r&d tax credits now so valuable for startups?

-

5:25

5:25

the new irs requirement for documentation with amended r&d tax claims

-

2:10

2:10

can i do an r&d tax credit if my startup is losing money?

-

0:56

0:56

what counts as research and development in r&d tax credit?

-

3:01

3:01

3 tips to not miss out on an r&d tax credit

-

0:22

0:22

how to use r&d tax credit to offset payroll taxes

-

3:30

3:30

how does the r&d tax credit affect my payroll taxes?

-

4:16

4:16

how to account for r&d tax credit refund

-

1:10

1:10

how the r&d credit benefits small and start-up businesses (rdcb)