is repatriation of overseas money required to pay for fbar penalties?

Published 3 years ago • 93 plays • Length 5:42Download video MP4

Download video MP3

Similar videos

-

4:23

4:23

fbar penalties - 2020 irs foreign bank & financial account form penalty (fincen form 114 penalties)

-

5:02

5:02

does form 8938 replace the fbar fincen form 114: fbar vs 8938

-

5:14

5:14

which foreign assets should taxpayers disclose for fatca?

-

6:13

6:13

fbar penalties - what if you filed late or never filed the form? (golding and golding) 2023

-

3:46

3:46

flora rule and fbar federal court penalty litigation: is full payment required?

-

13:25

13:25

international taxation 101 - a beginners guide to international tax, reporting, penalties and waiver

-

10:20

10:20

foreign pension employment trust reporting irc 401/402: foreign pension income tax, fbar & fatca.

-

8:00

8:00

new immigrant u.s. tax, fbar, & fatca income rule examples - golding & golding (board-certified)

-

8:02

8:02

fbar & fatca australian superannuation - 2020 reporting a super on fincen form 114, form 8938 & 3520

-

5:16

5:16

what fbar investment accounts are reported on fincen 114

-

6:55

6:55

fbar requirements - what does irs require

-

6:10

6:10

provident fund & us tax treatment: fbar & fatca

-

6:00

6:00

estate fbar filing - decedent & offshore accounts, fbar, form 8938 & foreign account penalties.

-

7:25

7:25

how to avoid penalties on late filed fbar - tax lawyers explain late foreign account disclosures.

-

5:17

5:17

fbar & fatca request form from a foreign financial institution

-

6:51

6:51

it is not difficult for irs to prove willful foreign account, fatca/fbar penalty: golding & golding

-

5:12

5:12

singapore us tax & reporting guide: fbar & fatca

-

5:45

5:45

delinquent form 8938 & abatement of penalty for late-filing

-

9:05

9:05

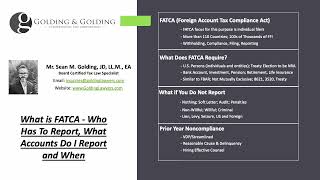

2024 fatca for individuals (foreign account tax compliance act): golding & golding (board-certified)