looking to get out of the us federal tax system - golding & golding (board certified tax specialist)

Published 1 year ago • 279 plays • Length 7:43Download video MP4

Download video MP3

Similar videos

-

6:14

6:14

do u.s. visa holders file us taxes? (common tax examples) - golding & golding (board-certified)

-

5:36

5:36

the us/australia tax treaty superannuation analysis: golding & golding; board-certified specialist

-

3:58

3:58

taxation of dual-status aliens (an overview) - golding & golding (board certified tax specialist)

-

5:18

5:18

am i under irs criminal tax investigation (golding & golding, board certified tax law specialist)

-

2:31

2:31

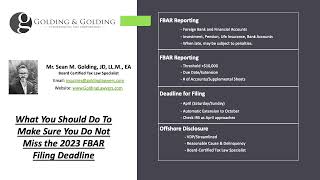

deadline for filing the fbar 2023: why you should prepare early so you do not miss the due date

-

6:09

6:09

new and easy tax guide to cryptocurrency taxation rules & reporting 2023

-

0:34

0:34

case dismissed in 34 seconds!

-

4:06

4:06

does first time abatement apply to international penalties - golding & golding (tax specialist)

-

0:40

0:40

how much does a tax analyst make?

-

13:25

13:25

international taxation 101 - a beginners guide to international tax, reporting, penalties and waiver

-

6:02

6:02

puerto rico resident us tax purposes

-

5:24

5:24

unreported foreign accounts - which legal strategy to choose (golding and golding, a plc)

-

6:41

6:41

quick guide to us income tax on worldwide income

-

0:23

0:23

how much i made as a corporate lawyer #shorts

-

5:36

5:36

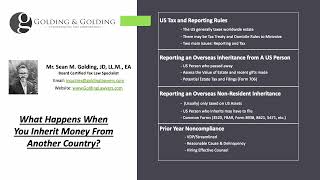

what happens when you inherit money from another country (golding & golding, board-certified in tax)

-

4:40

4:40

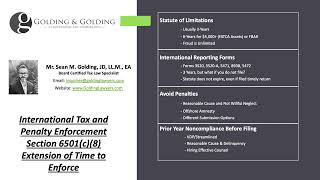

international tax and penalties section 6501(c)(8) extension of time to enforce - golding & golding

-

6:31

6:31

ovdp penalty: updated calculation & how irs calculates penalties under offshore voluntary disclosure

-

4:42

4:42

fdap income - international tax law introduction