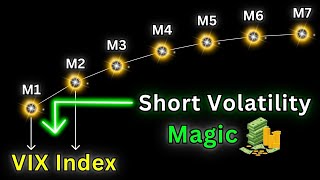

making sense of vix term structure: a one day measurement

Published 7 months ago • 183 plays • Length 0:46Download video MP4

Download video MP3

Similar videos

-

4:54

4:54

vix trading system - back tested trading algorithm - part 1

-

5:17

5:17

vix futures explained - vital for short volatility traders

-

5:15

5:15

market crash indicator - cash vix term structure

-

![synthetic indices; how to plot key levels [revealed]](https://i.ytimg.com/vi/B20wSlPfJjc/mqdefault.jpg) 23:59

23:59

synthetic indices; how to plot key levels [revealed]

-

15:38

15:38

how to trade volatility indices| institutional trading strategies

-

12:02

12:02

how to scalp spikes in the $vix

-

2:25

2:25

flat vix term structure

-

10:52

10:52

crude oil futures trading lesson | advanced trading strategies $/cl $oil $vix

-

2:17

2:17

how the vix is calculated: yahoo finance breaks down expected volatility in the s&p

-

10:33

10:33

gold and silver volatility trade | implied volatility gold | $gdx | $gdxj

-

9:08

9:08

vix term structure explained | volatility trading concept

-

6:13

6:13

the volatility index (vix) explained

-

5:52

5:52

how to use the vix index explained with strategy

-

![[$8,000 loser: case study] how to trade stock options, how to trade ipo lock ups - trade options](https://i.ytimg.com/vi/NiUScy1o5uc/mqdefault.jpg) 14:13

14:13

[$8,000 loser: case study] how to trade stock options, how to trade ipo lock ups - trade options

-

2:31:30

2:31:30

fed fallout, ecb's move | bloomberg surveillance 06/15/23

-

3:16

3:16

what the vix futures curve signals for u.s. stocks

-

1:15

1:15

vix suggests s&p still has a way to go

-

![[trade idea] how to trade iran oil sanctions w/ crude oil futures | crude oil news | opec](https://i.ytimg.com/vi/02NnaeBE2Pg/mqdefault.jpg) 8:51

8:51

[trade idea] how to trade iran oil sanctions w/ crude oil futures | crude oil news | opec

-

2:08

2:08

vix futures term structure inverted

-

2:06

2:06

vix futures in backwardation

-

5:21

5:21

how to make sense of the rise in the volatility index