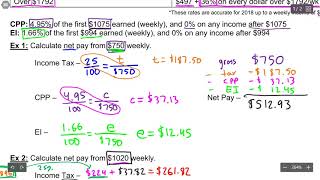

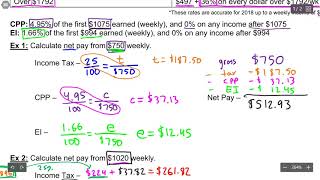

my pay stub in canada // payroll deductions - income tax, cpp & ei // canadian tax guide ch 12

Published 1 year ago • 103K plays • Length 17:02

Download video MP4

Download video MP3

Similar videos

-

8:06

8:06

what are cpp, ei, and income taxes - statutory deductions for canadian payroll

-

8:23

8:23

understand payroll deductions on your pay stub

-

7:40

7:40

wage and tax deductions in canada 2023 (how to calculate your paycheck)

-

20:22

20:22

payroll deductions in alberta, canada (simplified—weekly!): income tax, cpp, and ei explained.

-

13:52

13:52

accountant explains important tax changes in canada for 2024 | tfsa, rrsp, fhsa, cpp & tax brackets

-

6:57

6:57

deferring cpp makes no sense!

-

6:06

6:06

why taking cpp at 65 is the worst possible option

-

6:58

6:58

huge cpp changes for 2024 // canada pension plan

-

12:04

12:04

understanding your pay stub canada - part 2: deductions

-

15:36

15:36

how taxes work in canada | reduce your tax bill | canadian tax guide chapter 1

-

7:22

7:22

understanding payroll deductions at source (pdas) in canada

-

2:48

2:48

learn about your taxes: the one about your pay stub

-

9:07

9:07

understanding your pay stub canada - part 1: hours, rates, and total

-

1:34

1:34

tax basics: how taxes work in canada

-

12:53

12:53

cpp, explained - everything you need to know about the canada pension plan (cpp vs oas)

-

7:00

7:00

how to calculate canadian payroll tax deductions - guide

Clip.africa.com - Privacy-policy

8:06

8:06

8:23

8:23

7:40

7:40

20:22

20:22

13:52

13:52

6:57

6:57

6:06

6:06

6:58

6:58

12:04

12:04

15:36

15:36

7:22

7:22

2:48

2:48

9:07

9:07

1:34

1:34

12:53

12:53

7:00

7:00