section 80ccc, 80ccd(1), 80ccd(1b), 80ccd(2), nps tax benefits, contribution to pension funds

Published 2 years ago • 132K plays • Length 11:26Download video MP4

Download video MP3

Similar videos

-

3:07

3:07

section 80ccd(2) - employer's contribution to nps | nps in new tax regime | nps deduction income tax

-

5:50

5:50

nps tax benefit guide 2024 - national pension system (scheme) details

-

9:17

9:17

nps deduction under income tax,nps tax benefits,80c,80ccd(1),80ccd(1b),80ccd(2)🔔🔔🔔🔔

-

4:12

4:12

tax deduction under section 80c, 80ccc & 80ccd in tamil

-

7:14

7:14

nps tax benefit - sec 80c and additional tax rebate

-

7:28

7:28

term life insurance explained

-

15:19

15:19

🔴nps vs ppf🟢 | which is a better retirement plan? lla nps ep#2 financial advice

-

8:33

8:33

i'm aiming for $80,000 max tax relief this year - how you can save on your taxes too!

-

6:18

6:18

nps tax benefits | nps in new tax regime benefits | nps deduction income tax 2024

-

0:25

0:25

section 80ccd (1b) deduction: tax deduction for nps contribution - icici direct

-

8:23

8:23

nps tax benefit u/s 80ccd1) 80ccd2) and 80ccd(1b) | nps tax benefits for govt other employees

-

12:05

12:05

tax benefits under section 80c, 80ccc, 80ccd(1) and 80ccd(1b)

-

8:57

8:57

deduction u/s 80ccc to 80ccd(1)-80ccd(1b)-80ccd(2 ) ii invest in nps ii #cavedtaya

-

0:59

0:59

mr. rai zyada saves 'zyada' tax by investing in national pension system (nps) under section 80ccd

-

2:50

2:50

80ccd 2 deduction under new tax regime | employer nps deduction u/s 80ccd(2)

-

9:11

9:11

80ccd(1b) nps tax benefit - ₹50000 (national pension system) tax exemption- invest or not

-

1:00

1:00

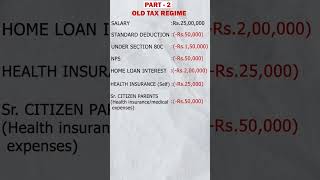

old tax vs new tax regime (fy 2023-24):which one would you choose? let's understand with an example

-

0:42

0:42

what is the nps tax benefit?

-

3:00

3:00

what is section 80 ccd(1b) | income tax deductions on national pension scheme (nps)

-

2:07

2:07

know-how to claim tax benefit for additional investment in nps |future generali india life insurance

-

19:28

19:28

tax benefits for tier 1 account in nps | nps tier 1 tax benefit | nps tier 1 benefits | nps tax rule