orange earnings valuation reference line utilizing three formulas

Published 8 years ago • 1.9K plays • Length 12:29Download video MP4

Download video MP3

Similar videos

-

17:44

17:44

how fast graphs draws fair valuation reference lines

-

5:46

5:46

three major valuation methodologies

-

10:34

10:34

7 - utilizing various valuation metrics to make better investment decisions | fast graphs

-

11:45

11:45

how do i screen for stocks where the price is below the orange line

-

5:53

5:53

how peter lynch values a stock! (peter lynch's valuation tutorial)

-

27:04

27:04

argo blockchain plc - q3 results

-

5:36

5:36

pe ratio explained simply | finance in 5 minutes!

-

9:47

9:47

stock multiples: how to tell when a stock is cheap/expensive

-

25:56

25:56

primer on valuation testing the wisdom of ben graham’s formula (part 1) | fast graphs

-

5:32

5:32

what are stock valuations methods & formulas?

-

17:29

17:29

fast graphs tutorial: the normal p/e ratio (the blue line) – what it is and how it works

-

18:01

18:01

the proper utilization and interpretation of fast graphs

-

32:25

32:25

topic 3: key metrics and other multiples | fast graphs

-

13:54

13:54

the essence of valuation is soundness not rate of return: part 1

-

21:07

21:07

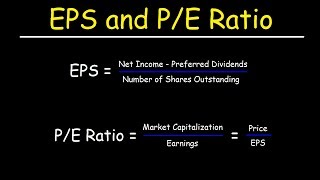

price to earnings (p/e) ratio and earnings per share (eps) explained

-

12:57

12:57

equity valuation

-

31:41

31:41

predicting future value: unlocking valuation secrets with growth projections (part 2 of 3)

-

16:06

16:06

stock valuation: know when to hold ‘em know when to fold ‘em | fast graphs

-

29:43

29:43

how to calculate the intrinsic value of your stocks (part 1 of 3) | fast graphs

-

9:51

9:51

3 simple stock valuation methods to calculate entry price