public provident fund (ppf)| taxability of ppf | benefits of ppf | section 80c| lock-in period

Published 1 year ago • 1K plays • Length 1:00Download video MP4

Download video MP3

Similar videos

-

1:00

1:00

should i prefer ppf or nps for retirement planning? nps versus ppf when you have 30 years to retire

-

1:00

1:00

7% of ppf better than 11% of mutual funds. how? #llashorts 108

-

0:29

0:29

ppf calculator yearly 60000 #shorts

-

1:00

1:00

should i start an sip or invest in lump sum? | ca rachana ranade | #shorts #backtobasics

-

1:03

1:03

stop investing in ppf | new tax regime | budget 2023 | ca raghav singhania

-

0:58

0:58

80c ke alawa bachaye rs 15600 tak ka tax #nps

-

0:58

0:58

sip आज ही बन्द कर दो 😨😨 #shorts #sip #mukulagrawal #ytshorts

-

1:00

1:00

which is better ppf or tax saver fd #finance #tax

-

1:00

1:00

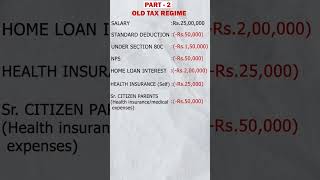

old tax vs new tax regime (fy 2023-24):which one would you choose? let's understand with an example

-

0:15

0:15

tax saving investments | reminder | section 80c | how to save tax? | ca talkies!

-

1:00

1:00

should you reinvest in elss to save tax?

-

0:52

0:52

ppf account benefits you should know...

-

0:16

0:16

income tax saving #scheme | best tax saving tricks | #tax saving schemes | #investment #incometax

-

1:00

1:00

have you exhausted your tax savings for fy 2022-23 ?

-

1:00

1:00

how to save tax from section 80c? #shorts #savetax #section80c #taxsaving

-

1:00

1:00

7 ways to reduce your income tax! #shorts

-

0:56

0:56

secret way to save tax !

-

1:00

1:00

top 3 elss mutual funds | tax saving funds