qualified business income deduction (qbi), explained.

Published 2 months ago • 422 plays • Length 3:34Download video MP4

Download video MP3

Similar videos

-

0:33

0:33

the qualified business income (qbi) tax deduction (u.s. tax)

-

9:32

9:32

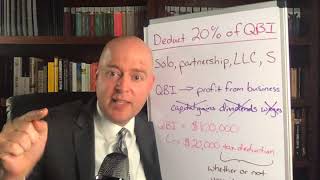

how to take the 20% qbi tax deduction | cpa explains section 199a qualified business income

-

18:11

18:11

introduction to qualified business income deduction | section 199a. cpa exam reg ea exam

-

19:54

19:54

qualified business income deduction: limitation. cpa/ea exam

-

11:04

11:04

qbi: qualified business income deduction explained and tax strategy | 20% pass thru deduction 199a

-

32:30

32:30

tax strategies: qbi (qualified business income/section 199)

-

10:43

10:43

rental property tax deductions | investing for beginners

-

4:00

4:00

get an llc to avoid paying high taxes?

-

37:45

37:45

qualified business income deduction for tax returns

-

7:59

7:59

qualified business income deduction (for dummies!)

-

1:23

1:23

quick tip: how to maximize the qbi deduction (qualified business income)

-

7:58

7:58

qualified business income deduction (qbi) simplified for small business owners

-

0:35

0:35

what is the qualified business income (qbi) deduction and what type of businesses does it apply to?

-

4:41

4:41

tax associates tips – qualified business income (qbi) deduction

-

12:05

12:05

how to file irs form 8995 for qualified business income (qbi) deduction for schedule c business

-

18:27

18:27

#taxtiptuesday | qualified business income (qbi) deduction explained

-

25:23

25:23

qualified business income qbi

-

15:00

15:00

specified service (trade) business: qualified business income deduction 199a

-

10:34

10:34

what is the qualified business income deduction and who qualifies?

-

46:00

46:00

am i eligible for the qualified business income (qbi) deduction?

-

3:41

3:41

what is qbi or qualified business income?