irr explained for real estate investors (is internal rate of return the best metric?)

Published 3 years ago • 14K plays • Length 7:06Download video MP4

Download video MP3

Similar videos

-

11:17

11:17

what the irr metric really means for real estate investors

-

4:26

4:26

irr explained for real estate investors (is internal rate of return the best metric?)

-

3:12

3:12

what is irr (internal rate of return) in real estate? why does it matter?

-

7:36

7:36

what is irr? | internal rate of return equity multiples in real estate explained | re for noobs 5

-

21:08

21:08

how to calculate internal rate of return (irr) for real estate investing

-

8:23

8:23

how to calculate internal rate of return “irr”

-

![cash-on-cash returns explained [full breakdown]](https://i.ytimg.com/vi/WmSD1na8xK8/mqdefault.jpg) 11:13

11:13

cash-on-cash returns explained [full breakdown]

-

12:36

12:36

a way better metric than cash on cash return

-

9:45

9:45

discounted cash flow analysis (dcf) in real estate explained

-

13:38

13:38

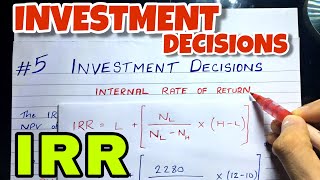

#5 internal rate of return (irr) - investment decision - financial management ~ b.com / cma / ca

-

5:45

5:45

multifamily investing 101 | irr explained

-

5:22

5:22

what a good irr looks like in real estate investing

-

1:31

1:31

what is internal rate of return? | why is irr important?

-

2:37

2:37

understanding internal rate of return (irr)

-

2:50

2:50

irr definition (internal rate of return) | finance strategists | your online finance dictionary

-

3:46

3:46

real estate investing explained - loan to value vs. loan to cost | gowercrowd

-

4:04

4:04

real estate investing explained - investing in debt vs. equity | gowercrowd

-

2:55

2:55

how internal rate of return (irr) can be manipulated

-

1:47

1:47

why you can’t always trust irr in a real estate investment

-

2:15

2:15

irr or cash-on-cash return and when to use which

-

6:45

6:45

how to break internal rate of return (irr)

-

![irr vs. npv - which to use in real estate [& why]](https://i.ytimg.com/vi/hGw2J__2adU/mqdefault.jpg) 10:39

10:39

irr vs. npv - which to use in real estate [& why]