s corporation restricted stock disclosures - what's reported on form 1120s

Published 3 years ago • 417 plays • Length 4:24Download video MP4

Download video MP3

Similar videos

-

36:15

36:15

how to fill out form 1120-s for 2021. step-by-step instructions

-

8:16

8:16

how is income allocated for an s corporation form 1120-s?

-

14:00

14:00

irs form 7203 - sale of s corporation stock with suspended losses

-

13:31

13:31

s corporation health insurance deduction on form 1120-s

-

3:45

3:45

irs form 1125-e disclosure of officer compensation

-

10:55

10:55

uk restricted stock units (rsus) explained - tax, vesting, selling

-

9:16

9:16

company review: my accenture experience

-

15:09

15:09

business owner pays tax on s-corporation distribution

-

3:58

3:58

✅ s corporation taxes explained in 4 minutes

-

24:21

24:21

sale of s corporation stock: section 1.1368-1(g) election

-

12:11

12:11

how to deduct health insurance for s corporation shareholders on form 1120-s and form 1040

-

7:18

7:18

restricted stock units: the basics & taxes

-

14:52

14:52

irs form 7203 - s corporation loss limitations on stock basis

-

8:28

8:28

how restricted stock units (rsus) work and how they're taxed

-

40:47

40:47

how to file form 1120-s for 2022 - lawncare business example

-

29:32

29:32

how to file a final form 1120-s for the 2023 tax year - step-by-step guide

-

14:02

14:02

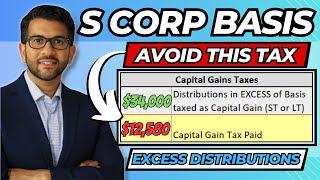

s corp basis explanation | distributions in excess of basis

-

18:24

18:24

irs form 7203 - s corporation losses allowed with stock & debt basis

-

0:57

0:57

tax benefits of a side hustle llc

-

51:10

51:10

how to file form 1120-s for 2022 - restaurant example

-

6:55

6:55

how to complete irs form 7203 - s corporation shareholder basis