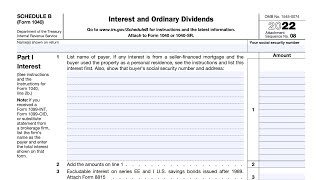

schedule b and irs form1040 - foreign accounts, fbar, interest and dividends

Published 3 years ago • 1K plays • Length 7:56Download video MP4

Download video MP3

Similar videos

-

4:55

4:55

court holds fbar error on schedule b (foreign accounts) can still be non-willful - golding & golding

-

4:16

4:16

schedule b explained - irs form 1040 - interest and dividends - explained

-

18:58

18:58

irs schedule b walkthrough (interest and ordinary dividends)

-

9:34

9:34

how to complete schedule b of form 1040

-

6:55

6:55

fbar requirements - what does irs require

-

7:09

7:09

is foreign retirement reported to irs on international forms fbar, 8938, 8621 and 3520

-

6:13

6:13

fbar penalties - what if you filed late or never filed the form? (golding and golding) 2023

-

buletin utama, 30 oktober 2024

-

6:57

6:57

fbar audit - foreign account compliance examination process

-

live: chancellor rachel reeves delivers labour's first budget

-

5:54

5:54

top 6 common fbar reporting mistakes to avoid

-

5:25

5:25

fbar violations - irs penalty investigations for foreign & offshore account violations (new update)

-

5:35

5:35

i missed the fbar filing deadline, what should i do? (golding and golding board-certified in tax)

-

6:57

6:57

tax year 2021 foreign account reporting and asset filing tips new for 2022 (golding & golding)

-

7:25

7:25

how to avoid penalties on late filed fbar - tax lawyers explain late foreign account disclosures.

-

1:59

1:59

2022 fbar filing due date to report 2021 fbar (fincen form 114) - golding & golding

-

5:19

5:19

foreign income and amending (1040x) tax return -- irs international reporting forms

-

12:44

12:44

how to fill in schedule b of form 1116 for foreign tax credit (ftc) carryovers

-

17:50

17:50

how to fill out fbar (foreign bank account report) fincen form 114