settlements and 1099s: navigating payor reporting requirements

Published 6 months ago • 465 plays • Length 0:52Download video MP4

Download video MP3

Similar videos

-

0:58

0:58

taxability of settlement proceeds

-

1:01

1:01

understand your business' form 1099 filing requirements

-

11:19

11:19

form 1099-s on form 1040 for 2022 - principal residence exclusion

-

5:44

5:44

preview :: 1099 reporting of settlements and payments to attorneys

-

5:47

5:47

i owe the irs $100,000 with my ex!

-

28:12

28:12

rental income and expenses - turbotax - 1099-misc

-

22:25

22:25

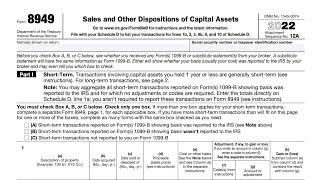

irs form 8949 walkthrough (sales and other dispositions of capital assets)

-

0:52

0:52

decoding the 1099: understanding payor obligations

-

4:47

4:47

what is irs form 1099-misc: what it is and what it's used for?

-

12:24

12:24

irs form 1099-s walkthrough (proceeds from real estate transactions)

-

1:00

1:00

new irs reporting requirements for payment apps in 2024

-

19:29

19:29

farm expense; raising calves; false 1099-misc; ownership reporting; blowing dirt liability

-

0:55

0:55

failing to file forms 1099 can lead to heavy penalties for businesses

-

7:02

7:02

🚨 tax form 1099-misc explained | what is irs form 1099-misc

-

17:53

17:53

navigating debt forgiveness: a comprehensive guide to reporting and excluding income (irs form

-

0:54

0:54

how the irs catches you for tax evasion

-

0:15

0:15

the deadline for e-filing form 1099 misc with the irs is march 31st.

-

6:59

6:59

tax form 1099-misc explained || rent, royalty, prizes income

-

17:21

17:21

irs form 1099-int walkthrough (interest income)

-

0:15

0:15

the deadline for e-filing form 1099 misc with the irs is march 31st

-

0:21

0:21

when you are not required to report attorney payments in 1099 misc?

-

6:03

6:03

accountant reads 1099s payment card transaction faqs & instructions