saver's credit explained 2022 | retirement savings contributions credit

Published 2 years ago • 5.1K plays • Length 7:02Download video MP4

Download video MP3

Similar videos

-

1:00

1:00

special depreciation allowance examples income tax 2023

-

8:09

8:09

sep ira explained: huge tax savings for self-employed individuals!

-

21:32

21:32

how to prepare s-corp tax return - proseries software

-

8:32

8:32

savers credit | retirement savings contributions credit

-

10:57

10:57

save tax on sale of house property | capital gain tax on sale of property |ca pritish burton

-

4:54

4:54

advance premium tax credit repayment. how does it work?

-

17:11

17:11

how s corp taxes work

-

7:59

7:59

module 7: refundable credits (earned income tax credits)

-

8:17

8:17

how to calculate sep ira contributions for an s corporation

-

0:59

0:59

what is federal unemployment tax act - financial accounting payroll

-

![savers credit changes [secure act 2.0]](https://i.ytimg.com/vi/rcmeeyfFyCM/mqdefault.jpg) 0:29

0:29

savers credit changes [secure act 2.0]

-

![[part-2] ((this rebate comes u/s 86, not u/s 89)) computation of tax liability, diract tax law](https://i.ytimg.com/vi/yaCCknzTYDM/mqdefault.jpg) 20:09

20:09

[part-2] ((this rebate comes u/s 86, not u/s 89)) computation of tax liability, diract tax law

-

0:54

0:54

save long term capital gain :- 54 of income tax act, 1961 #shorts #viralshorts #youtubeshorts

-

42:24

42:24

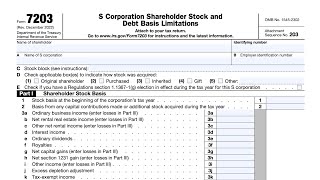

irs form 7203 walkthrough (s corporation shareholder stock and debt basis limitations)

-

1:00

1:00

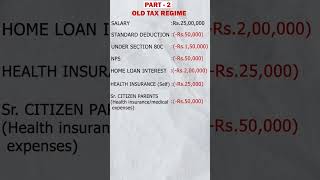

old tax vs new tax regime (fy 2023-24):which one would you choose? let's understand with an example

-

57:49

57:49

asc 326 cecl accounting standard implementation guide

-

0:10

0:10

taxmann – a solution to your tax problems for over 6 decades ❤️#ytshorts #trendingshorts

-

0:19

0:19

books of accounts in income tax act | who needs to maintain them? part-6 by ca anand thakor

-

0:45

0:45

allowances in salary | income tax | ay 2020-21 | bcom | mcom | bba | #shorts

-

4:07

4:07

refundable & non-refundable tax credits

-

1:00

1:00

practical example on tds on salary, section 192 of income tax act, 1961.