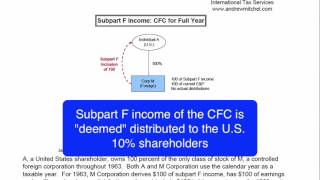

subpart f income of controlled foreign corporations | u.s. taxation

Published 3 years ago • 16K plays • Length 7:42Download video MP4

Download video MP3

Similar videos

-

21:17

21:17

controlled foreign corporation | subchapter f income | international c{pa exam

-

13:16

13:16

subpart f income part 1 - overview

-

1:40

1:40

blick rothenberg - us tax explained - subpart f income

-

1:03

1:03

1.951-1(b)(2), example 1, subpart f income with cfc for full year

-

1:36

1:36

1.951-1(b)(2), example 2, subpart f income with cfc for first part of year

-

52:34

52:34

form 5471: foreign tax credit

-

12:29

12:29

how hmrc taxes foreign income

-

7:16

7:16

know cfc rules if you want to live tax-free

-

5:08

5:08

cfc rules - tax trap for controlled foreign corporations

-

58:18

58:18

form 5471: subpart f income

-

1:53

1:53

1.951-1(b)(2), example 5, subpart f inc. with cfc for last part of year & pre-acq'n div. paid

-

1:15

1:15

1.951-1(b)(2), example 4, subpart f income - hopscotch rule

-

1:47

1:47

1.951-1(b)(2), example 3, subpart f income with cfc for last part of year

-

3:39

3:39

where to report subpart f income - irs form 5471

-

11:37

11:37

what are the controlled foreign corporation (cfc) tax rules?

-

1:45

1:45

2023 #7 subf de minimis exception

-

3:42

3:42

retroactive extension of tax provisions concerning subpart f income of cfcs

-

1:17

1:17

1.956-2(c)(3), example 3, u.s. property - pledge of cfc stock

-

1:32

1:32

1.954-3(a)(1)(iii), example 1, foreign base company sales income

-

1:27

1:27

1.954-3(a)(1)(iii), example 3, foreign base company sales income

-

0:45

0:45

1.956-2(c)(3), example 1, u.s. property - pledge of cfc assets

-

7:37

7:37

form 5471, page 1