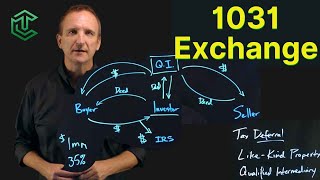

tax advisor talks 1031 exchange, cost segregation and bonus depreciation | episode 7 | 29 mins

Published 2 years ago • 148 plays • Length 29:11Download video MP4

Download video MP3

Similar videos

-

9:08

9:08

cpa explains the #1 real estate tax deduction: cost segregation explained

-

16:45

16:45

unlock huge tax benefits: depreciation & cost segregation studies

-

21:11

21:11

1031 exchange step by step case study

-

23:00

23:00

deferred sales trust vs 1031 exchange

-

19:37

19:37

cost segregation made simple

-

0:29

0:29

cost segregation study on a 1031 exchange

-

1:00:39

1:00:39

real estate tax 101 - cost segregation and bonus depreciation | ep 75 - the nick huber show

-

6:19

6:19

what is cost segregation and how to use it | (full analysis)

-

1:03:41

1:03:41

tax benefits owning real estate; advanced cost segregation, depreciation, 1031 exchange, and more

-

5:09

5:09

what is a 1031 exchange & should you use one?

-

10:26

10:26

the 1031 exchange explained (tax free appreciation!)

-

5:32

5:32

how to defer depreciation recapture in a 1031 exchange

-

3:52

3:52

1031 exchanges | real estate exam prep concepts

-

4:44

4:44

1031 exchange - calculating depreciation

-

23:54

23:54

1031 exchange explained: a real estate strategy for investors

-

9:21

9:21

overcoming objections... the truth about cost segregation studies

-

5:53

5:53

explained: what role does depreciation play in a 1031 exchange? (michael brady & alex shandrovsky)

-

10:29

10:29

deferring capital gains taxes in real estate with a 1031 exchange - everything you need to know

-

10:31

10:31

1031 exchange | what you need to know

-

8:19

8:19

tax depreciation: business owners (2023)