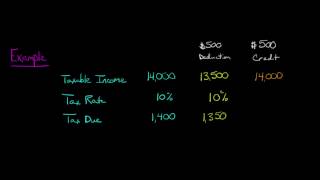

tax deductions vs tax credits - canadian income tax t1

Published 3 years ago • 448 plays • Length 5:25Download video MP4

Download video MP3

Similar videos

-

14:13

14:13

what are refundable vs non-refundable tax credits - canadian income tax t1

-

3:40

3:40

refundable vs non refundable tax credits?

-

2:54

2:54

personal taxes - donations tax credits

-

11:23

11:23

personal tax rate brackets 2021 - income tax t1

-

5:53

5:53

tax deductions vs. tax credits

-

8:55

8:55

schedules when filing canadian income tax t1 - personal taxes

-

8:01

8:01

tax credits vs tax deductions: what is the difference and which is better?

-

6:13

6:13

tax treatment of premiums, benefit/proceeds, dividends - life insurance exam prep

-

7:10

7:10

tax avoidance diukur dgn cash effective tax rate (cetr) dan effective tax rate (etr)- daily lisajon

-

19:12

19:12

day in the life of a tax director!

-

4:25

4:25

how to do uber drivers tax filing? canadian taxes? the t2125 tax filing

-

15:25

15:25

what is tax on split income (tosi) - income tax t2

-

8:06

8:06

what are cpp, ei, and income taxes - statutory deductions for canadian payroll

-

10:36

10:36

why study our income tax t1 course?t1 general form, how to file tax return?

-

0:30

0:30

tax credits vs tax deductions

-

2:31

2:31

claiming tuition credits?

-

9:48

9:48

why study income tax t2 (corporate taxes) ?

-

12:17

12:17

understanding the t1 general income tax form - canadian personal taxes

-

9:02

9:02

why study our canadian payroll course? learn about cpp, employment insurance and income taxes.

-

7:26

7:26

what are tax credits? cpa explains how tax credits work (with examples)

-

4:06

4:06

tax deduction vs. tax credit... explained.