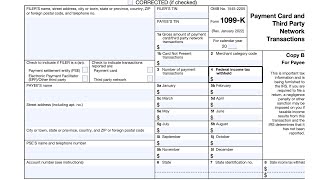

tax on $20,000 form 1099-k

Published 5 years ago • 1K plays • Length 0:59Download video MP4

Download video MP3

Similar videos

-

0:59

0:59

tax on $50,000 form 1099-k

-

0:58

0:58

tax on $30,000 form 1099-k

-

1:00

1:00

tax on $40,000 form 1099-k

-

1:02

1:02

form 1099-k report it or not?

-

9:02

9:02

form 1099-k & your tax benefits for this year

-

25:00

25:00

irs form 1099-k walkthrough (payment card & third party network transactions)

-

0:21

0:21

e-file 1099 k instructions 2022

-

0:59

0:59

major tax implication for 2024 ➡️ 1099-k reporting

-

0:58

0:58

report 1099-nec or 1099-k?

-

0:51

0:51

form 1099-k from paypal

-

6:15

6:15

the truth about the 1099-k thresholds and if you have to report that income

-

8:23

8:23

where do i report form 1099-k on my tax return?

-

0:27

0:27

1099k forms - what you need to know #tax #taxtips #selfemployed

-

8:30

8:30

how to best report the new 1099-k tax forms for $600

-

0:05

0:05

🚨 alert: the 1099-k tax form is coming for you! if you’re using payment apps like cash app,

-

1:00

1:00

what is tax form 1099-k?

-

0:53

0:53

irs 1099k reporting rules: new update

-

0:12

0:12

special alert - irs delays form 1099-k reporting threshold! #1099k #taxpreparer #taxseason2023

-

0:33

0:33

1099 k | form 1099 online | irs1099 k form | 1099 e file service 2020

-

0:57

0:57

how to receive your tax info 1099/misc, nec or 1099-k as a uber driver

-

0:54

0:54

irs delays the implementation of $600 or more reporting on 1099-k'

-

11:09

11:09

form 1099-k walkthrough: how to report the sale of a personal item at a loss on your tax return