taxes: calculating the burden and government revenue

Published 3 years ago • 5.3K plays • Length 25:14Download video MP4

Download video MP3

Similar videos

-

6:25

6:25

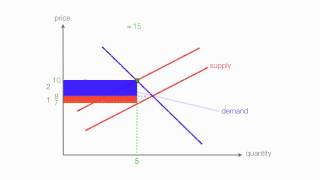

how to calculate excise tax and determine who bears the burden of the tax

-

5:58

5:58

taxes on producers- micro topic 2.8

-

3:06

3:06

taxes on consumers | part 1 | tax revenue and deadweight loss of taxation | think econ

-

11:31

11:31

tax revenue and deadweight loss

-

5:05

5:05

taxation as a public revenue source

-

47:12

47:12

22. government redistribution and taxation

-

5:38

5:38

lower taxes, higher revenue | 5 minute video

-

12:29

12:29

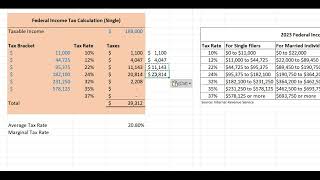

calculating federal income taxes using excel | 2023 tax brackets

-

2:12

2:12

micro unit 6, question 12- tax incidence (excise tax)

-

14:56

14:56

micro: unit 1.5 -- excise taxes and tax incidence

-

0:32

0:32

ndp mp lindsay criticizes taxes, says they make life harder for canadians

-

14:39

14:39

tax burden | excess tax burden and equilibrium after tax #taxburden #perunittax #taxrevenue #lse

-

1:31

1:31

how do governments raise revenue?

-

12:10

12:10

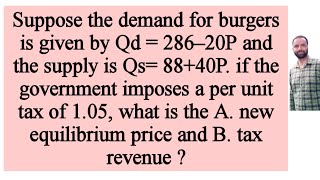

per unit tax and tax revenue #microeconomics

-

16:04

16:04

equilibrium price and tax revenue after the imposition a per unit tax from demand & supply function

-

7:27

7:27

economic incidence/burden of a tax

-

0:42

0:42

take a look at the new tax slab for taxpayers according to the new tax regime announced by the fm

-

5:48

5:48

burden of taxation: relationship to price elasticity of supply and demand

-

0:29

0:29

budget 2024: income tax slabs unchanged | subscribe to firstpost

-

10:48

10:48

understanding estimated income taxes!

-

19:58

19:58

tax basics: a beginner's guide to everything

-

9:06

9:06

taxation and dead weight loss | microeconomics | khan academy