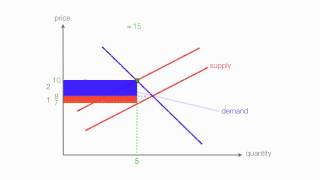

taxes on consumers | part 2 | tax revenue and deadweight loss of taxation | think econ

Published 7 months ago • 3.4K plays • Length 5:39Download video MP4

Download video MP3

Similar videos

-

3:06

3:06

taxes on consumers | part 1 | tax revenue and deadweight loss of taxation | think econ

-

4:43

4:43

taxes on producers | part 2 | tax revenue and deadweight loss of taxation | think econ

-

5:58

5:58

taxes on producers- micro topic 2.8

-

3:12

3:12

taxes on producers | part 1 | tax revenue and deadweight loss of taxation | think econ

-

11:31

11:31

tax revenue and deadweight loss

-

9:06

9:06

taxation and dead weight loss | microeconomics | khan academy

-

10:13

10:13

y1 16) indirect tax - full market impact

-

15:14

15:14

taxes on buyers and sellers

-

32:21

32:21

chapter 8: the costs of taxation

-

6:25

6:25

how to calculate excise tax and determine who bears the burden of the tax

-

0:33

0:33

us tax revenue part 5b #money #taxes #usa #government #federal

-

0:53

0:53

us tax revenue part 5 #taxes #corporate #usa #federalgovernment #government #money

-

0:59

0:59

fab eco- 4 - sources of non-tax revenue #tax #nontax #economics

-

0:29

0:29

us tax revenue part 8 #money #income #taxes #government #usa

-

1:03:29

1:03:29

topic 4: optimal taxation part 2 | economics 2450a: public economics

-

18:54

18:54

taxes 02: welfare implications

-

51:23

51:23

principles of microeconomics 10. application: the costs of taxation (ch. 8)

-

0:41

0:41

us tax revenue part 9 #taxes #government #usa #money

-

0:15

0:15

us tax revenue part 6b #money #income #taxes #property #federalgovernment #usa

-

6:54

6:54

adam smith, book 5, ch. 2, pt. 1-2, sources of the public revenue

-

6:02

6:02

taxes part 2/3: government tax revenue - why is it a box and which box??? a-level ib economics!