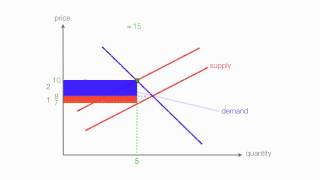

taxes on producers- micro topic 2.8

Published 10 years ago • 1.5M plays • Length 5:58Download video MP4

Download video MP3

Similar videos

-

6:25

6:25

how to calculate excise tax and determine who bears the burden of the tax

-

11:29

11:29

taxes on consumers part 1

-

3:06

3:06

taxes on consumers | part 1 | tax revenue and deadweight loss of taxation | think econ

-

10:13

10:13

y1 16) indirect tax - full market impact

-

5:28

5:28

y1 17) indirect tax and elasticity (consumer, producer and government evaluation)

-

11:31

11:31

tax revenue and deadweight loss

-

3:08

3:08

taxes

-

8:36

8:36

supply and demand: the case of taxes

-

8:23

8:23

economic vs statutory tax burden / tax incidence

-

47:12

47:12

22. government redistribution and taxation

-

9:06

9:06

taxation and dead weight loss | microeconomics | khan academy

-

14:56

14:56

micro: unit 1.5 -- excise taxes and tax incidence

-

2:12

2:12

micro unit 6, question 12- tax incidence (excise tax)

-

7:39

7:39

tax incidence: do producers pass the full burden of a tax onto the consumer

-

3:04

3:04

tax incidence tax on producers

-

8:55

8:55

how to calculate excise tax and the impact on consumer and producer surplus

-

11:27

11:27

taxes and elasticity (where the tax incidence fall entirely on consumers )

-

7:53

7:53

impact of taxation | shifting of taxation | effects of taxation | concepts of incidence (eco 20)

-

8:09

8:09

economics as’level(taxes and elasticity: where the burden of tax falls entirely on producers)

-

7:03

7:03

microeconomics i the tax burden on consumers and producers

-

0:32

0:32

realizing excise tax burden isn’t that hard - microeconomics