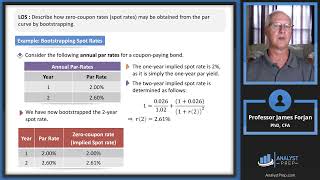

cfa level 1 full course: the term structure of interest rates - spot, par, and forward curves

Published 4 months ago • 1.4K plays • Length 31:22Download video MP4

Download video MP3

Similar videos

-

4:51

4:51

the spot curve and forward curve explained in 5 minutes

-

42:00

42:00

the term structure and interest rate dynamics (2024 level ii cfa® exam –fixed income–module 1)

-

42:04

42:04

kaplanlearn module 57 1 the term structure of interest rates spot, par, and forward curves

-

6:18

6:18

how to calculate spot rates and forward rates in bonds

-

32:13

32:13

fixed income instrument features (2024/2025 cfa® level i exam – fixed income – learning module 1)

-

59:52

59:52

the term structure and interest rate dynamics (2021 level ii cfa® exam – reading 32)

-

6:52

6:52

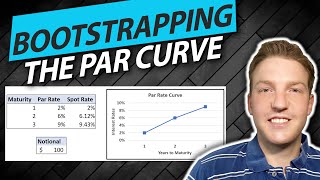

bootstrapping spot rates from the par curve

-

16:04

16:04

spot rates and forward rates (soa exam fm – financial mathematics – module 4, section 6)

-

22:41

22:41

cfa level 1 full course: yield and yield spread measures for floating-rate instruments

-

4:03

4:03

pass rate explained | inside the cfa program

-

8:58

8:58

riding the yield curve and rolling down the yield curve explained

-

13:13

13:13

term structure of interest rates - theoretical spot rates

-

21:04

21:04

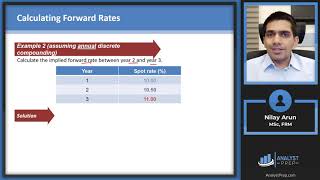

spot rate vs. forward rates (calculations for cfa® and frm® exams)

-

10:34

10:34

cfa level 2 | fixed income: bootstrapping spot rates from par rates & no-arbitrage valuation

-

42:32

42:32

credit risk (2024/2025 cfa® level i exam – fixed income – learning module 14)

-

18:36

18:36

cfa level i yield measures spot and forward rates video lecture by mr. arif irfanullah part 1

-

11:22

11:22

cfa level i yield measures spot and forward rates video lecture by mr. arif irfanullah part 5

-

2:03

2:03

cfa level iii exam grading process | inside the cfa program

-

1:28

1:28

term structure of interest rates

-

1:00:35

1:00:35

mm-curves - mario kummer

-

14:20

14:20

the expectations theory. yield curve. term structure of interest rate. cost accounting. cpa exam