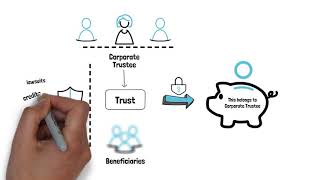

trusts explained | types, tax benefits, and asset protection in australia

Published 1 month ago • 4 plays • Length 4:43Download video MP4

Download video MP3

Similar videos

-

14:02

14:02

trusts explained australia: reduce tax boost asset protection (inc. family trusts australia)

-

8:12

8:12

5 reasons why australians love trusts

-

13:46

13:46

how do trusts get taxed? basics of trust taxation & can they pay no tax?

-

4:23

4:23

explainer: the two categories of trusts in australia

-

0:22

0:22

step 1: the basics of establishing a trust explained!

-

7:43

7:43

5 assets that should never go into a living trust

-

6:04

6:04

how the australian tax system works in 2024 (explained in 5 minutes)

-

47:07

47:07

all about trusts - misuses and uses (how to avoid trust scams)

-

59:51

59:51

how trust can maximise tax benefits and asset protection

-

0:54

0:54

the truth about domestic trusts: why they fall short when you need them most!

-

0:43

0:43

the power of land trusts in tax optimization and asset protection #shorts

-

20:17

20:17

what is a living trust and what are the benefits? (living trust 101)

-

0:59

0:59

trust assets and taxes explained.

-

1:00

1:00

you want the irrevocable trust for asset protection.

-

6:42

6:42

family trusts explained for australians

-

0:55

0:55

foreign vs domestic asset protection trusts

-

7:09

7:09

should i buy property under a trust or personal name? | australian tax optimisation | land tax

-

![☝💰🏡structuring: what legal entity to choose? [reducing taxes, asset protection, estate planning]](https://i.ytimg.com/vi/StdB9DP8pjU/mqdefault.jpg) 23:31

23:31

☝💰🏡structuring: what legal entity to choose? [reducing taxes, asset protection, estate planning]

-

2:35

2:35

living trusts explained in under 3 minutes

-

0:23

0:23

protect your assets with an asset protection trust!

-

0:17

0:17

domestic asset protection trust

-

0:33

0:33

commonly used trusts explained - estate planning definitions