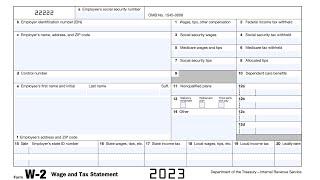

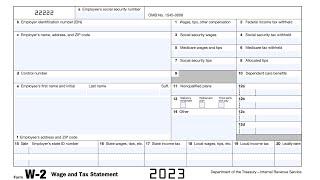

w2 - yearly wages or tax statement - 1003 session #19, employment section# 4

Published 4 years ago • 3.5K plays • Length 24:51

Download video MP4

Download video MP3

Similar videos

-

15:09

15:09

difference between 2017 & 2018 tax returns (forms # 1040) - 1003 session #25 employment section #4

-

14:02

14:02

4506t, 4868 tax extn & irs transcript - 1003 session #24, employment section #4

-

31:03

31:03

over time, bonus, commission & form #1005 - 1003 session #18 - employment section# 4

-

14:59

14:59

1003 session # 13 section iv - part # i - employment information

-

18:15

18:15

basic of employment info & underwriting - 1003 session # 14

-

13:54

13:54

how to avoid taxes... legally (do this now)

-

4:00

4:00

get an llc to avoid paying high taxes?

-

13:53

13:53

who is eligible? c2c, w2, 1099 | tax terms & visas | us it recruiting | suman pachigulla | very easy

-

13:44

13:44

1099-r, non- employee comp., interest, alimony & child support -1003 session #21 employment section

-

23:10

23:10

year to date income - ytd, tax & other deductions -1003 session # 17 section

-

6:39

6:39

what are different forms to calculate rental income 1003 session # 31

-

18:28

18:28

irs form w-2 walkthrough (wage and tax statement)

-

21:44

21:44

identify taxable & non-taxable income on tax returns - 1003 session # 29

-

0:44

0:44

payroll taxes ➡️ self employed (1099) vs. w2 employee

-

18:05

18:05

retirement, ssa, non - employee compensation, grossed or non taxable income - 1003 session #20

-

21:53

21:53

irs form # 1040 – individual tax returns – 1003 session # 23

-

20:01

20:01

ssa 1099, 1099misc, pension or ssa award letter - 1003 session #22 employment section #4

-

18:43

18:43

business income - schedule e - partnership & s. corp. - underwriting & 1003 session # 34 (part 1)

-

15:49

15:49

how to identify business income or self employed borrower - 1003 session # 27 - employment section

-

0:41

0:41

how to avoid paying taxes...legally

-

20:48

20:48

underwriting: wage, retirement, ssa & all other income documents

-

0:49

0:49

what is form w-2 (wage and tax statement)?

Clip.africa.com - Privacy-policy

15:09

15:09

14:02

14:02

31:03

31:03

14:59

14:59

18:15

18:15

13:54

13:54

4:00

4:00

13:53

13:53

13:44

13:44

23:10

23:10

6:39

6:39

18:28

18:28

21:44

21:44

0:44

0:44

18:05

18:05

21:53

21:53

20:01

20:01

18:43

18:43

15:49

15:49

0:41

0:41

20:48

20:48

0:49

0:49