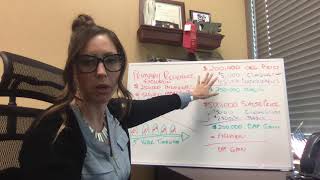

what is the section 121 primary home exclusion?

Published 1 month ago • 70 plays • Length 1:00Download video MP4

Download video MP3

Similar videos

-

12:29

12:29

home sale capital gains exclusion -121 exclusion explained

-

12:55

12:55

how to avoid capital gains tax when selling real estate (2023) - 121 exclusion explained

-

1:32

1:32

what is the section 121 exclusion?

-

5:08

5:08

how to skip the taxes when selling your home - section 121 exclusion

-

1:08:47

1:08:47

tutorial: how to exclude capital gain from the sale of a personal residence (irc section 121)

-

7:02

7:02

how to avoid capital gains tax when selling investment property in australia

-

28:48

28:48

estate tax and inheritance problems versus bir aimp | how it is done

-

7:32

7:32

convert a 1031 exchange property to a primary residence

-

6:51

6:51

how to take advantage of the 121 exclusion

-

2:23

2:23

capital gains tax explained 2021 (in under 3 minutes)

-

14:45

14:45

section 121 home sale personal residence gain exclusion

-

3:32

3:32

principal residence exemption | what you need to know!

-

3:03

3:03

capitial gains primary residence exclusion.

-

0:51

0:51

tax tip | section 121: the home sale gain exclusion

-

1:12:58

1:12:58

how combining section 121 (primary residence) and 1031 exchange will keep your money yours!

-

30:08

30:08

how to avoid capital gains tax when selling real estate (2019) - 121 exclusion explained

-

4:31

4:31

capital gains on your primary home?

-

9:48

9:48

watch out for capital gains when selling your house

-

9:14

9:14

don't convert your primary residence into a rental property

-

10:57

10:57

how to legally pay 0% capital gains tax on real estate

-

9:00

9:00

capital gains tax when you sell a home: exclusion, tax rate, how to calculate your gain, & exemption